Tax Credit Scholarships: Questions and Answers

Q: What are tax credit scholarships?

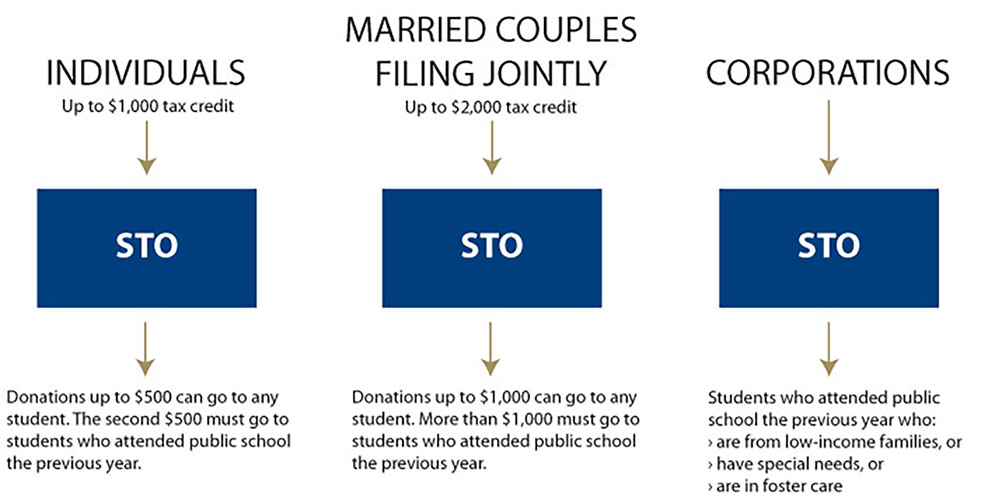

A: Under Arizona law, individuals and corporations can donate money to school tuition organizations (STOs), which are non-profit organizations that form in order to award private school scholarships to elementary and secondary students. Donors can receive a tax credit for their donations (under certain limits).

Q: Is Arizona’s tax credit scholarship law constitutional?

A: Yes. In April 2011, the U.S. Supreme Court rejected a challenge to the program in Arizona Christian School Tuition Organization v. Garriott, ending a lawsuit filed more than a decade before. Opponents claimed the program used public dollars to promote religious causes. Writing for the majority, Justice Anthony Kennedy wrote that when Arizona taxpayers contribute to scholarship organizations “they spend their own money, not money the State has collected from respondents or from other taxpayers.”

Q: Who is eligible to receive a scholarship?

A: For donations made by individuals, STOs can use their discretion in awarding scholarships to K-12 students. For donations from corporations, the funds must be used for students from low-income families (families whose income does not exceed 185 percent of the poverty line) who attended a public school in the prior year. Under a second corporate tax credit, known as Lexie’s Law, corporations can donate funds to STOs to be used for scholarships for students with disabilities or in foster care who also attended public schools in the prior year.

Q: How much can individuals or businesses contribute?

A: Individuals can contribute as much as they would like, but they can only receive a tax credit for donations of up to $1,000. For married couples filing jointly, they can receive a credit on donations of up to $2,000. However, for any individual contribution over $500 ($1,000 for a married couple), an STO must use those funds for students who are switching from a public school to a private school (the Department of Revenue annually adjusts the dollar amounts according to the Consumer Price Index).

Limits on the total tax credits awarded for corporate contributions are capped at just over $20 million. This limit increases by 20 percent annually.1 There is a $5 million annual cap on contributions for scholarships under Lexie’s Law.

Q: Is there a limit to the size of a scholarship that is awarded?

A: There is no limit on scholarships awarded using contributions from individuals or married couples. For scholarships funded by corporate donations, awards are capped at $4,700 for grades K-8 and $6,000 for 9-12. These amounts increase by $100 annually. For students with special needs or in the foster care system, scholarships cannot exceed 90 percent of what the state would have spent on a child or the tuition cost at the chosen private school, whichever is less.

Q: Can students receive scholarships from more than one STO?

A: Yes. According to the Arizona Department of Revenue, “The scholarship limit applies to the scholarship received from each STO; it does not apply to the total scholarships received from all STOs in aggregate.”2

Q: Can a scholarship organization provide scholarships for only one school?

A: No. A scholarship organization must award scholarships to at least two schools.

Q: Can donors specify the student for whom a contribution should be used?

A: No. STOs must determine their own criteria (under the limitations described above) for making awards, and donors cannot direct their contributions for a specific student.

Q: Can a scholarship organization use any donations to cover administrative fees?

A: Yes. STOs can use up to 10 percent of donations to cover administrative costs.

Q: How many students are participating in the different scholarship programs?

A: In 2011, 74,687 individual donations were made, totaling over $51 million. That year, 25,312 scholarships were awarded, totaling over $47 million.

Also in 2011, 69 businesses donated over $11 million for scholarships for low-income students. 4,578 scholarships were awarded. Eight corporations donated over $1 million for scholarships for displaced students or students with special needs.3 115 scholarships for displaced students and students with special needs were awarded.

1 Arizona Department of Revenue, “Private School Tuition Organization Income Tax Credits in Arizona: A Summary of Activity FY2011,” available at http://www.azdor.gov/Portals/0/Reports/2011-Private-School-Tuition-Organization-Individual-and-Corporate-Income-Tax-Credit-Report.pdf (accessed February 8, 2012).

2 Arizona Department of Revenue, “A Manual for School Tuition Organizations,” available at http://www.azdor.gov/LinkClick.aspx?fileticket=CKcT5ZKMobY{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}3d&tabid=136 (accessed February 8, 2012).

3 Arizona Department of Revenue, “Private School Tuition Organization Income Tax Credits in Arizona: A Summary of Activity FY2011.”

Get Connected to Goldwater

Sign up for the latest news, event updates, and more.

Recommended Blogs

Donate Now

Help all Americans live freer, happier lives. Join the Goldwater Institute as we defend and strengthen freedom in all 50 states.

Donate NowSince 1988, the Goldwater Institute has been in the liberty business — defending and promoting freedom, and achieving more than 400 victories in all 50 states. Donate today to help support our mission.

We Protect Your Rights

Our attorneys defend individual rights and protect those who cannot protect themselves.

Need Help? Submit a case.