How Cities Drive Economic Growth in Five Easy Steps

January 9, 2015

Introduction

Cities across the country struggled through the recent recession, and several even declared bankruptcy, including Stockton and San Bernardino in California, Harrisburg, Pennsylvania, Central Falls, Rhode Island, and, perhaps most famously, Detroit.1 Stockton’s decline has been harrowing as its finances have so declined that essential services, especially the police, have been reduced. The city’s gang and narcotics teams had to be disbanded even as the city saw its murder rate hit an all-time high in 2012. Even before its bankruptcy, Detroit had a plan on the table to reduce costs by demolishing abandoned houses and commercial buildings.2 The city’s decline has been so thorough that it has been used as an example of what happens to buildings in The History Channel’s Life After People series.3

Nine cities have seen job losses near 10 percent and may never fully recover, including two, in the arid, oil-depleted part of Texas as well as two Nevada cities, and one each in California, Illinois, Connecticut, Georgia, and Michigan.4 During the recession, the Phoenix-Mesa-Glendale metro lost more than 13 percent of its private employment and private employment is still more than 5 percent below its pre-recession peak.5 Phoenix’s finances suffered so badly, they found it necessary to impose a sales tax on food that persists to this day. Both Mesa, Arizona and Phoenix continue to suffer tepid growth in revenues with Mesa City Hall continuing a four-day, 10-hour per day public employee workweek to save on building maintenance and Phoenix having to adjust to yet another disappointing revenue picture.6

As a consequence of the recession and slow recovery, municipal governments are considering ways to strengthen their economies and become more business friendly in an effort to set their fiscal houses in order. A key ingredient is making city administration more efficient and less burdensome for businesses. Many theories about what government can and should do to make a city attractive to investment and job creation distract from focusing on what must be done. One theory promotes the clustering of certain similar businesses, such as biotech.7 Another related theory involves the clustering of certain classes of workers, particularly “young creatives.”8 Still others focus on sports amenities and tourism venues. Time and again, though, research shows that when seeds of development fall on fertile soil, they grow, naturally and organically, the fertile soil being favorable institutions.9 These include privatization, procurement reform, transparency, deregulation, and personnel reform. By keeping taxes low and making cities flexible enough to quickly adapt to economic fortunes as they are influenced by the entire globe, these measures lead to wealth creation and healthy economic development.

Read the PDF version here

For example, the city of Phoenix recently enacted reforms that have made the city friendlier to new business. These reforms included some zoning simplification, but the real accomplishment has been in streamlining construction permitting, especially when remodeling existing business space. Effectively, the city has privatized construction permitting for certain projects by certifying architects to act as surrogates for city plan reviewers. The city calls this the Self-Certification Program. Architects can self-certify certain construction, landscape, grading and drainage/storm water, and parking lot plans.10 The results have been satisfying. There are 203 professionals allowed to self-certify projects. Since its inception, the program has seen 450 projects and 550 permits issued under the self-certification program with a project value of $450 million.11 The self-certification program could have easily saved a month in bringing these projects to fruition, translating into savings of $3 million.12 Even marginal reductions in cost of investing in a city can make it significantly more attractive for investment.

Cities have other opportunities for reform that can drive economic development and create jobs. These reforms include privatizing municipal services such as garbage collection and park maintenance. Cities should move to an at-will system of employment and do some modest reform of procurement policies. They can also move to a defined-contribution retirement benefit for new city employees who would fall under the city’s independent pension system. Reducing onerous small business licensing requirements, streamlining requirements for minor construction and remodeling permitting, and eliminating plant salvage requirements for new development would also do much to help businesses thrive. Finally, cities should carefully review and narrow their functions to core competencies.

1. Privatizing Services

Privatization does not mean the elimination of publicly-provided services. In fact, privatization can sometimes preserve the public provision of services by making them more affordable. Many city services can be contracted out to private companies who meet specific cost and performance requirements. Privatizing services can improve overall financial performance and improve government finances.13 Privatization is a superior driver of efficiency and cost savings through incentives that lead to better management techniques, more productive equipment, innovation, incentive pay structures, and efficient deployment of workers.14 This is because city administrators and taxpayers hold contractors responsible for performance without being concerned about union work rules and employees’ political connections when coupled with transparency policies. The benefits of contracting can be greatest when contracts are based on desired performance specifications (performance contracting) rather than contracting to have a job done a certain way, which is likely to be the way it’s always been done and which might be less efficient than how a contractor would choose to do it.

Privatize Trash Collection

Privatizing trash collection, in most cities, can save citizens 20 percent of their current trash collection costs.15 Detroit has turned to possible privatization of trash collection and has 10 bidders vying for the contract with the initial expectation that the city could save $15 million of its annual $50 million trash collection budget.16 Academic research has supported the notion that privatized trash collection is more efficient than traditional government-run trash collection.17

Privatize Park Maintenance

New York’s Central Park is privatized, supported by revenues from concessions and private contributions as are several other parks in the city.18 Complete privatization of parks that do not restrict admittance can be difficult, however. The unique parks of New York City rely on high-income contributors to non-profit administrators. That arrangement may be difficult to replicate. Minimally, though, landscaping duties such as mowing and basic grounds upkeep at other cities’ parks could be contracted to private providers. This would likely require bundling various parks in a rational way and contracting for upkeep of these bundled sites. Sports parks could be similarly contracted for trash cleanup and basic monitoring for upkeep.

Recently, Carlsbad, California, explored parks privatization opportunities and found that the city could save up to $4.7 million per year. Moreover, reducing responsibility for parks relieves the city of equipment ownership and upkeep. Personnel needs are reduced along with associated costs such as pension contributions and various insurances. Properly structured contracts with closely monitored performance criteria that focus on park appearance and functionality can produce the sort of efficiencies that lead to significant savings, just as privatized trash collection tends to do.

Privatize Golf Courses

Many cities own and operate golf courses, but only about 10 percent of the U.S. population plays golf and the sport’s popularity is waning.19 It is unclear why the other 90 percent should subsidize any city’s municipally-owned golf courses. The City of Phoenix has long owned and operated golf courses but in 2011-12 alone Phoenix city golf courses ran a $2.4 million deficit and have run an annual deficit since 1998-99 except for a single modest surplus year. Phoenix’s golf enterprise fund has accumulated a total deficit of $17 million.20 City courses compete with private enterprise and generate no property tax revenues.

Golf course privatization alternatives include: 1) selling the courses with a proviso that they remain golf courses, 2) inviting proposals from private parties for lease/management contracts to run the courses, and 3) outsourcing golf course maintenance, as Phoenix is currently doing with five of the courses. The City of Tucson has seen the desirability of comprehensively privatizing municipal golf courses through lease/management contracts after seen million dollar deficits running the courses themselves.21/22 In the case any city losing money on an amenity that is provided by private enterprise, if the three privatization alternatives fail to completely halt the financial bleeding, the courses should be sold.

Some might object that golf courses and other amenities are economically beneficial and that closing golf courses, even if they are subsidized, would be an unwise thing to do purely from an economically pragmatic point of view. However, economic studies purporting to show benefits from parks and golf courses show only that values of homes abutting and near parks and golf courses are more valuable than those further distant.23 This is hardly a justification for taxing everyone else to support a minority’s pastime.

Privatize Road Maintenance

Road maintenance can be privatized by making contracts with private companies to maintain roads to an objectively determined standard of smoothness and repair.24 As an example of what can be accomplished, the state of Colorado recently privatized U.S. Highway 36 between Boulder and Denver to include maintenance.25 While cities do not administer highways, they can designate particular areas for privatization, perhaps initially as a pilot program. City road contract administrators would need to set performance standards of ongoing smoothness and repair in addition to standards of street quality to be met at the end of the contract. Performance contracting involves determining penalties for lack of performance and timeliness as well. Typically, such contracts are for terms of around five years and involve soliciting bids according to performance measures and yearly fixed rates the city would pay. Countries around the world have already implemented performance-based contracting in road maintenance, and parts of the United States are already seeing savings between 10 and 15 percent.26

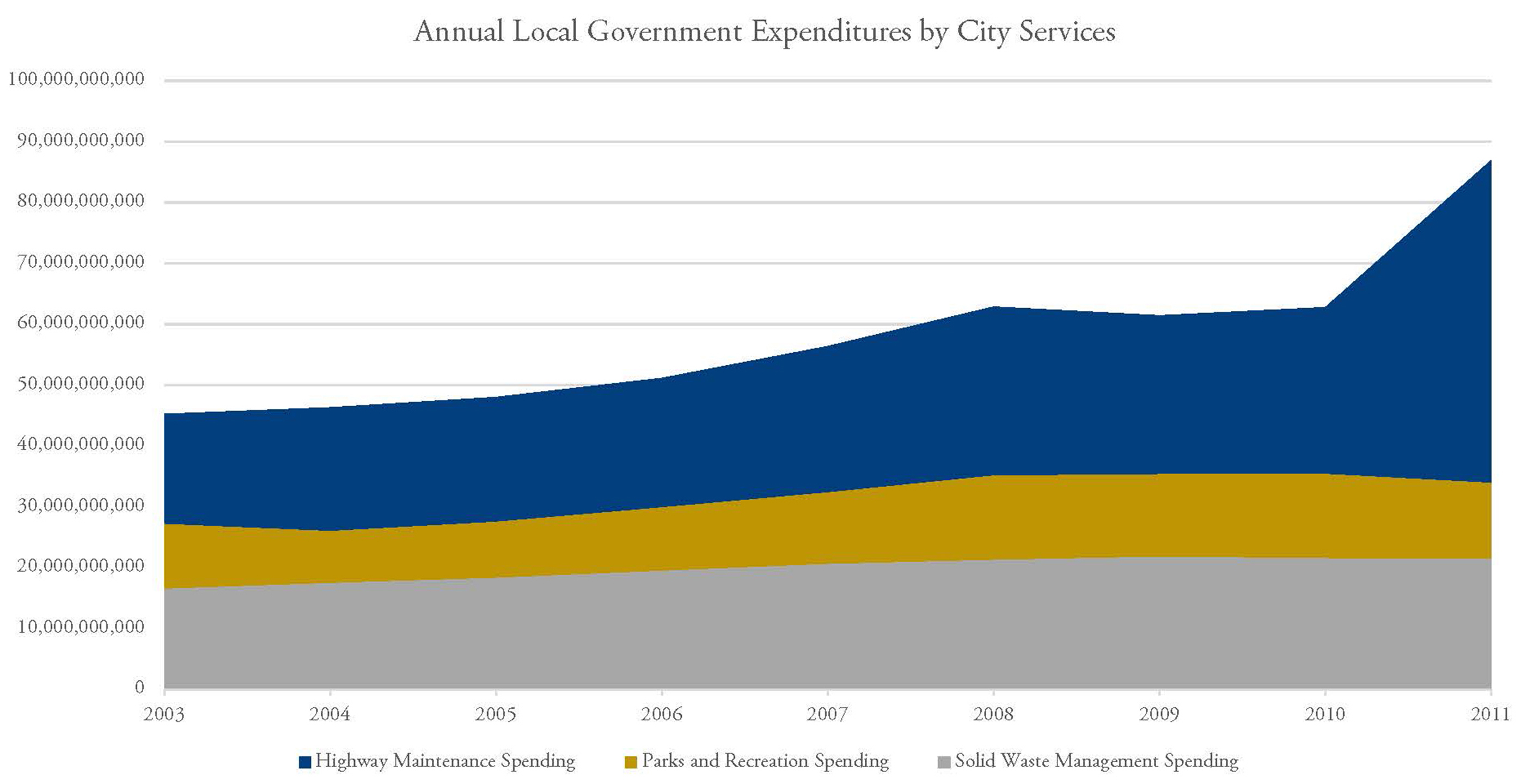

| Figure 1: Annual Local Government Expenditures by City Services |

|

| Source: US Cencus Bureau, 2002-2011 |

Privatize Transit

The privatization of transit has shown itself a viable, effective option when cities make room for it. Private bus and van service presents itself as a solution, without direct government action, to urban transportation problems that occur in cities all over the world. The United States has seen these services spontaneously arise repeatedly in cities when highly regulated taxi services and government-provided mass transit underserve some areas.27 Private transit can be relatively unobtrusive since the vehicles used are relatively small and nimble. Such services can stop briefly in front of peoples’ houses rather than cutting off a lane on city arterials as passengers disembark and embark. Also, routes are flexible, not fixed to a rail line or even necessarily a fixed schedule. Service can accommodate a variety of tastes and price points as well, by adjusting service such as number of interim stops, vehicle accommodations, and the number of fellow passengers. Finally, private transit creates economic opportunities for low-income individuals to provide the service by becoming drivers and even eventually owning their own fleet of vehicles.

High-end driver services like Uber, Lyft, and Sidecar have proven that more personalized, private transit services are in demand.28 All three use smartphone software to match people needing a ride with private individuals willing to provide a ride in their personal vehicle for a fee. Uber operates in 36 U.S. cities as well as in cities in 26 countries. Lyft operates in 20 U.S. cities, often in competition with Uber. These services use technology and driver and rider reviews to ensure safety and quality of service without the heavy hand of regulation. The same technology that matches single riders with rideshare-service-affiliated drivers could be used to more efficiently route less expensive van services for multiple riders and already is being used, to some extent, for airport shuttle services and taxis. The technology could be more widely applied and even better developed for inexpensive van services but for the concern that transit authorities might interfere with these services’ development, as they have in various cities, and the fact that public transit is subsidized, making private van services all the more financially risky.29

As private transit is accommodated, steps should be taken to phase out standard public transportation, including buses. Low-income riders can be assisted more efficiently with their transportation needs using an income-based transportation voucher system in a city with privatized transit.

2. Reforming Business Processes

Cities can reap great savings and become more efficient, making lower taxes possible, by streamlining several of their business processes. First, moving all employees to an at-will status can enhance productivity while saving money. Second, procurement processes should be reviewed to ensure transparency and competitiveness.30 Another reform includes eliminating business preference programs that add layers of government without adding value for taxpayers and citizens.

Employment

Civil service protections, in an age of transparency, are arguably outdated and unnecessary. Communication, technology and the availability of informational outlets makes it possible for anyone treated unjustly to make their case known. Public knowledge of unfair practices on the part of a public employer creates a discipline all its own. Yet, many cities still follow civil service practice by granting what is, in effect, tenure for employees after only a short time of satisfactory employment. In Phoenix, as in many other cities, if an employee is evaluated after her first year as a good employee, she has the right to appeal demotion and termination decisions.31 The Phoenix Civil Service Board has overturned or modified as many as a third of personnel discipline actions. It takes a number of steps to terminate the employment of someone who has shown even egregious behavior.32

Moving to an at-will employment policy along the lines of that promulgated by the Texas Municipal League would free cities from extended, costly employment proceedings.33 In 2012, the State of Arizona made this move, making all new employees subject to at-will employment with the exception of public safety personnel. Under the new law, supervisors are to adhere to a set of six principles that are intended to protect both taxpayers and employees from arbitrary managerial decisions and ensure that the best employees are retained and advanced.34 Couple that with other state and national laws that prohibit discrimination and protect employees from repercussions for engaging in free speech, city managers would still have to document employees’ poor performance in order to impose discipline.35 However, it would be far less likely that it would take years to terminate a problem employee.36

The benefit to taxpayers of moving to an at-will system would include savings from the removal of deadwood from public employment and improve service from city employees. The cost savings from not having suspended employees on the payroll could immediately save hundreds of thousands of dollars per year. Additional savings would accrue from preventing their accumulation of pension benefits. Finally, some savings will accrue from a more streamlined (but not eliminated) system of due process for non-performing employees.

Procurement

Municipal procurement policies typically require bids to be sealed, opened in public, and judged by a committee. There can be conflicts of interest in the bidding process, however, if the writer of the request for proposals (RFP) has been involved in similar projects and worked with the same vendors over a period of years. The writer can strategically construct a grading rubric that leads to a specific contractor being chosen even if committee members are unaware of any ulterior motives.37 For these reasons, municipal contracting should be as transparent as possible. The following steps will help cities achieve fairness and transparency.

Tell Losing Vendors Why

When an award is made it should be accompanied with an explanation of why the vendor who received the award prevailed and specific reasons why other bidders did not. Some might fear that such an explanation from the city’s selection committee would hand ammunition to rival bidders who might sue if they see a decision as arbitrary. It is important, therefore, to not only make sure the decision is not arbitrary but to make sure proposal selection committee members are qualified to make such judgments. Then, the explanations must be clear and concise. In the end, the city might find that vendor bidding becomes more competitive because vendors will have a basis besides guesswork on which to improve their offers.

Write Performance-Based Specifications

Specifications can be too specific. A good example is Phoenix’s specifications for underground water pipe. They specify metallic pipe, which corrodes and eventually leaks. Other types of pipe such as PVC may have longer life and lower maintenance costs. Instead of specifying metallic pipe, Phoenix should specify in its RFP that the material should be suitable with a demonstrated low life-cycle cost. Even if the initial cost is a little higher, if the life-cycle cost is lower, that material should win the bid.38 Other examples might include the specification of only certain roofing materials for a building when the real issues are pleasing aesthetics and longevity, specific personnel qualifications when general qualifications would be sufficient, and the specification of certain brands of materials. Strategies too focused on specific elements are risky, not only for taxpayers’ wallets and government efficiency, but legally as well.39

Writing specifications that accurately describe the problem to be solved or the task to be accomplished or the purpose of a good or service is key. These performance-based measures allow firms to innovate and propose those innovations in their bids. Contract selectors generally have, or should have, the discretion to weigh a proposal’s risk, likely performance levels of bidders, their expertise, experience and practices, and the types of processes or materials they propose to use as well as other intangibles along with cost so that the lowest cost bid is not automatically the one selected if it involves achieving less than the best value for taxpayers.40

End Business Preferences

Many cities have instituted local business bid preferences to give local businesses a bid advantage on city procurement contracts. Tucson, Arizona grants businesses a 5 percent cost preference in bidding on city contracts. That is, their bids will be evaluated as if they bid a price 5 percent less than they actually bid. This could apply to any size contract. The Arizona cities of Chandler, Mesa, and Tempe offer bid preferences between 1.5 and 2 percent on contracts under $50,000.41 The City of Los Angeles has a program for small and local businesses that gives them a 10 percent bid advantage.42 The State of Texas has a statewide bid preference policy that both allows for such preferences but also sets limits for cities and school districts.43 The City of Chicago instituted a 2 percent local bid preference in 2012.44 These programs are ubiquitous throughout the United States.

The City of Phoenix has two programs designed to give advantage to local businesses. The Small Business Enterprise program encourages larger businesses to subcontract with local businesses where city contracts exceed $50,000. The Local Small Business Enterprise program reserves contracts worth less than $50,000 for local small businesses when three or more local businesses make a bid for a contract, regardless of whether a lower bid is made from a non-local business.45 Phoenix’s programs replaced earlier programs that worked more like those of other cities. The current programs seem designed more keep city employees with busy work than anything else.

All bid preference programs fail to minimize costs to taxpayers. Contractors who win a bid due to a bid preference provide no qualitative advantages since the preferences often apply only when two contractors are otherwise substantially similar. The only argument that can be made for such preferences is that they might keep tax monies local. Some regional economic models appear to make the case that keeping money local is economically beneficial, but this is really an argument against trade in general. Historical economic evidence proves that trade within and outside borders is always economically beneficial. Long-discredited Mercantilistic economic philosophies to limit trade outside certain borders were disproved even before Adam Smith wrote his famous tome, The Wealth of Nations, in 1776. Not only do these programs add costs for taxpayers, the added costs result in a redistribution of income from taxpayers to favored small business owners. And, the best quality of service and goods for taxpayers may not be attained. Finally, as is being increasingly demonstrated, these programs only foster more of the same in other cities as they compete to protect their local businesses and ultimately have a deleterious effect throughout the region and nation. Therefore, local business contract preference programs should be scrapped.

3. Defining and Concentrating on Core Functions

A key element in making cities attractive to business is to ensure governments focus on core functions and performing well. What many would consider core functions, such as providing roads and sewer, are very important to business formation and growth. By focusing on these functions, costs can be minimized and, in turn, taxes kept low, delays in construction minimized, and businesses can focus on doing business. Although a recent report based on surveys of entrepreneurs with fast-growing businesses makes the case that taxes and regulation are not a major factor in location decisions, the fact that these are relatively small businesses in fast-growth industries seems to be lost on the authors.46 There is no denying the general trend of companies and people moving to generally less-taxed and regulated cities and states.47

Determining what is a “core function” can be difficult and open to debate. Any determination of core functions must recognize that no government can possibly be all things to all people and do everything well. Government must be limited to those functions for which it is best suited and that are necessary but unlikely or impossibly accomplished through private means. Such endeavors as city-owned hotels, city-controlled development, city-financed art, and city-sponsored sports (like golf) are suspect. Core functions are likely to include police, some kind of provision for fire-fighting and emergency response, roads and other basic infrastructure like sewer and water.

There is a great deal of dispute regarding what constitutes core functions of different levels of government.48 Many clearly consider providing for health and welfare with government furnishing medical services, food, shelter, and other services to those in need a core function. Others do not. Certain criteria for determining core city functions readily present themselves if one presumes that individual liberty is to be preserved to the highest possible degree. Questions to be asked and answered in the affirmative to determine if a function is core include: 1) Does everyone inarguably benefit?; 2) Do overall benefits outweigh overall costs?; 3) Is it necessary in order to prevent damage to lives and property?; 4) Is it necessary to allow for travel, trade, and access to property?; 5) Is it necessary to protect overall health and welfare?; 6) Is it necessary for one of these purposes but the private sector cannot otherwise accomplish it? One question purposely not asked is “Does it make me feel better?” That mentality forces cities to take a subjective approach instead of focusing on results. Since everything the government does is the result of coercive taxation, its results must be objectively beneficial to all.

These questions must be constantly asked and answered. Something once considered a core function might fall out of favor later or vice versa. One key to an ongoing understanding and consensus regarding core functions is to adequately understand their costs. This means a city must keep its finances in order and transparent so that the citizenry can understand those costs and make informed decisions.

4. Putting and Keeping City Finances in Order

When it comes to city budgeting and finance, two issues stand out as ripe for reform. First is pensions. Many municipal pension funds are struggling, and cities face huge liabilities. Across the country, state and local unfunded pension liabilities are estimated at $3 trillion – $10,000 for every man, woman and child in the nation.49 Phoenix’s unfunded pension obligations alone amount to around $1.4 billion. Tucson’s are about half a billion dollars.50 Phoenix and Tucson carry per-capita pension costs that exceed those of bankrupt Stockton, California.51 The other issue is transparency, which would include creating searchable databases of city transactions.

Pensions

The central problem with pension funds is that they are inherently risky for taxpayers. First, present and past employees are guaranteed lifetime benefits, putting the onus of funding said promises on taxpayers. In many cities pension funding has become the highest priority in government budgeting. Many states have provisions in their constitutions like Arizona’s that effectively declare pension benefits sacrosanct and prioritize pensions over every other type of spending.52 Second, pension systems contribute to “fiscal illusion” that adds risk for taxpayers. For example, early retirement schemes that appear to save taxpayers money during recessions actually push the added costs of early, previously unanticipated retirements to later generations through the pension systems. Lawmakers are constantly adding benefits that appear affordable, often pushed to do so by active employees and their unions, only to set up taxpayers for the inevitable day that investments’ values fall. Third, pension systems are inherently corrupting and corruptible, as pension spiking schemes in Phoenix and elsewhere have demonstrated.53

Stockton, California, and Detroit have both declared bankruptcy, in no small part due to their pension obligations.54 Policymakers in these and perhaps hundreds of cities around the country, succumbed to public employee pressure to increase pension benefits without any increases in pension funding. During the 1990s, pension funds were seemingly awash in an endless ocean of cash and often more than 100 percent funded. Pension benefit increases such as increased retirement multipliers, like the early retirement Rule-of-80, and double-dipping programs that allow nominally retired employees to earn salaries at the same time they receive pensions looked like no-cost ways to effectively increase government employee pay. The inevitable day of reckoning first came with the relatively modest recession in 2000, but before pensions could fully recover from that shock, the even bigger recession of 2007 hit.

Stockton appears to be coming out of bankruptcy, but still without confronting the pension issues. Taxpayers have suffered a tax increase in a city already hard-hit economically, and bondholders have been moved to the back of the creditor line.55 After a federal judge determined that pensions were subject to reductions under Detroit’s bankruptcy, political battles to keep that from occurring continue to rage.56 In both cases, taxpayers are left holding the bag either through reduced services or higher taxes now and in the future as borrowing costs rise and the financial holes in the pension systems are filled. Just 61 cities in the United States had a total unfunded pension liability of $99 billion, according to the Pew Charitable trust.57 City finances will continue to suffer with forcing them to make personnel reductions in police and firefighting and to neglect infrastructure needs.

Cities can avoid these potentially devastating problems by moving away from pension (defined benefit) retirement benefits and toward 401(k)-style (defined contribution) retirement benefits. Taxpayers would only be liable for one-time, per-pay-period contributions to employees’ personal retirement accounts. Employees would have control over their accounts, which would be their exclusive property. In San Diego, a proposition to move public employees into defined contribution retirement benefit programs won overwhelming voter approval with 66 percent of the vote. In San Jose, California, major changes to the pension program to lower its costs passed by proposition with 69 percent of voters approving of the change. The benefits of such changes will take a long time to come to fruition, but they are worthwhile in order to secure the longterm financial viability of cities.

Financial transparency

Ensuring fiscal transparency can help cities streamline processes and reduce fees and taxes, all of which create a more hospitable business environment. With greater transparency, managers have more information at their fingertips and know that there just might be somebody looking over their shoulder. This encourages more careful decision making as watchdogs have a better chance of discovering inefficient government activity. Transactions should be posted online and include explanations in plain language of the purpose of each transaction. Accounting codes and categories are insufficient. Those who input the data would have to be counseled on appropriate privacy issues where necessary and coached on the proper balance between brevity and adequacy in the explanation. All such information should also be entered under oath.

As noted above, city pension systems currently present the greatest financial threat to communities. Total traditional debt carried by the city can be determined from a city’s Comprehensive Annual Financial Report. However, total debt, including general obligation bonds, revenue anticipation bonds, and unfunded obligations for pension systems should be prominently posted. And gross amounts should not be the only posted numbers. Per capita debt should be included because taxpayers deserve to know how much they and their children are obligated to pay to other parties, especially when they are constantly asked to approve measures that create even more debt.

Taxation & Revenue

Good tax policy is not just about keeping taxes low. It is also about keeping taxes from fundamentally determining economic decisions and outcomes. Income taxes fundamentally discourage work effort, investment, and risk taking. Property taxes discourage investment. Sales taxes would seem to discourage consumption except that much consumption will take place, regardless, due to necessity and people’s natural desire to consume. Of these three types of taxes, sales taxes distort the economy the least if they are equally applied to all goods and services. In most instances, property taxes are the most stable form of revenue. However, the income tax is the least stable and does the most to negatively impact economic activity.

To the extent that cities have discretion over their revenue sources, they should emphasize sales taxes over the others. To the greatest possible extent, city services should be provided self-sufficiently through fees. Property taxes make some sense as sources of revenue for local roads since road use is somewhat related to property wealth, but by all means, cities should resist instituting a local income tax.

5. Reducing Regulation

Licensing

In general, city business licensing is best characterized as registration and most cities in Arizona are not particularly heavy handed with business regulation except with respect to zoning laws. Of interest, though, is the disparity in the fees among the different types of licensed businesses. Some businesses are more favored than others. Taking Phoenix as an example, application fees for amusements are over $100 per game.58 Address curb painters pay $30.59 Massage businesses pay $550.60 Street vendors pay $150.61 Yearly renewal fees are lower for most businesses but similar disparities apply. Other cities show similar inequities.

All cities should review their business application and renewal fees for their necessity and rationality and consider whether occupations like curb painters and auctioneers should be regulated at all, even through mere registration requirements. In Phoenix, curb painters are regulated to the point of specifying the materials they should use despite the fact that homeowners are capable of evaluating them.62 Cities should review whether business permits and regulations are necessary.

| Figure 2: Number of Licenses/Permits/Tax Registrations Required by City for Selected Businesses |

| Source: License123 website, https://www.license123.com/Businesses |

Figure 2 shows the number of licenses and/or permits and/or tax registrations required of various businesses in a sampling of cities around the country. Some of the paperwork is required by state regulation and tax collection, but as illustrated by the disparities between Phoenix and Glendale, Arizona and between Los Angeles and San Francisco, clearly states are not the major culprits when it comes to requirements businesses must meet in order to open their doors.

Figure 2 confirms anecdotal evidence that Texas tends to be more lenient on business regulation than most. The number of filings required for this sample of businesses in Dallas averages less than seven, the lowest of the sample cities. It also confirms that San Francisco is particularly hostile to business with the average number of filings it requires at 15, a good deal higher than Los Angeles’ 9.2. In this sample of nine cities and according to the averages, Glendale, AZ is the second most regulating city while Phoenix is in sixth place.

One must wonder just what disasters are occurring in Dallas that the other cities in the list are seeking to avert. It is also interesting to see that although Phoenix ranks below New York in its business paperwork requirement overall in this comparison, Phoenix is worse than New York in its requirements on food trucks and family restaurants. Dallas serves an example of why cities should constantly review their business licensing and permitting requirements to see if they are more onerous than can be justified.

City licenses and permits should especially be reviewed for their job killing potential. What may seem like an innocuous regulation that appears to be simple common sense can practically kill a business. Phoenix serves as an example. A ubiquitous summer feature in many cities outside Arizona is the seasonal snow cone stand. These are often small, portable, temporary buildings built on skids or trailers located in a spot for the duration of the summer.63 But they are essentially non-existent in Phoenix despite the very hot summers. The reason for this likely lies in the city’s mobile vending licensing law.

According to Phoenix law, any “stand” “designed to be portable and not permanently attached to the ground” constitutes a “mobile vending unit” if anything is to be sold from it.64 Snow cone stands meet this definition. Phoenix law requires that mobile vending units on private property be “removed from the site during the hours of non-operation” and mobile food vendors are not allowed to operate between the hours of 2:00 am and 6:00 am.65 In other words, in the City of Phoenix the law specifies that a classic snow cone stand or any other business operating in a similar manner cannot operate using a common business approach that prevails in other cities. Moving a temporary building, even one the size of a snow cone stand, every evening would be prohibitively costly.

This law, which essentially prohibits very small startup food businesses, limits upward income mobility. It prevents entrepreneurial activity that was once the backbone of the vibrant American culture of pulling one’s self up by dint of hard work and risk-taking. It is not at all clear why the city insists that relatively temporary structures be removed in the night except that this rule helps to prevent competition for what might be considered more permanently established businesses. City law also favors food service in permanent structures by prohibiting anyone from managing more than one mobile vending unit at a time and requiring that a mobile vending licensee have a permanent Phoenix resident as an agent.66

Minor Home Maintenance Permitting

Cities often require residents to obtain permits and inspections to replace gas appliances, replace roofing, perform minor rewiring, install landscaping and irrigation systems and construct small out buildings on their property.67 Construction requirements often concern zoning regulation such as setback requirements. Others are due to alleged safety concerns. Much of the time, cities act as third-party experts on behalf of homeowners who otherwise know very little about basic construction, wiring and plumbing. In any case, there is a significant potential for safety and quality issues to arise if work is done improperly and the city is attempting to prevent problems.

Data pointing to the benefits of permits and inspections for remodeling is scant, however. Moreover, today there is less of a need for third-party experts as there is a great deal of information about proper construction on the internet and through home improvement centers. Many cities in Arizona have abandoned many of their permit requirements or have created exceptions for two reasons. First, there are obviously too few permits being issued in comparison to what one would expect. That is, clearly, residents are opting not to obtain required permits. The City of Chandler, AZ, for example, gets fewer than a thousand permits per year to replace water heaters when the number of permits should be several thousand per year. This leads to the second reason for eliminating this and other permit requirements. Despite the dearth of permits, houses are not catching on fire and water heaters exploding in the City of Chandler or other cities in Arizona. It turns out homeowners are not as ignorant as permit requirements seem to assume.68

Regardless of the magnitude of permit and inspection fees, the steps involved in obtaining them take time, which is a cost in itself. A homeowner doing minor rewiring or installing a ceiling fan for the first time also has to deal with the invasion of privacy that permits and inspections entail. With these inconveniences, it’s highly unlikely that even a majority of do-it-yourselfers bother to obtain a permit. Do-it-yourself homeowners concerned about their lack of knowledge can hire inspectors if they wish.

Permitting does not just impact do-it-yourself projects. It also impacts the cost and inconvenience of hiring a contractor. Consequently, homeowners are less likely to have work done or will delay it, depending on its nature, partly based on the time and expense of permitting. Although permitting costs and delays might seem minor, they do marginally negatively affect economic activity and are one more potential reason someone might choose to live elsewhere.

Conclusion

Municipal governments learned hard truths during the recent recession. Some in other states have even had to declare bankruptcy, and are losing jobs, businesses, and citizens. The key to revitalization lies not in giving favors to specific industries, but in creating a climate favorable to all business development. Streamlining government processes, reducing regulatory burdens, and improving government transparency are simple steps cities can take to get on the path to balanced budgets and economic growth.

Read the PDF version here

Get Connected to Goldwater

Sign up for the latest news, event updates, and more.

More on this issue

Recommended Blogs

Donate Now

Help all Americans live freer, happier lives. Join the Goldwater Institute as we defend and strengthen freedom in all 50 states.

Donate NowSince 1988, the Goldwater Institute has been in the liberty business — defending and promoting freedom, and achieving more than 400 victories in all 50 states. Donate today to help support our mission.

We Protect Your Rights

Our attorneys defend individual rights and protect those who cannot protect themselves.

Need Help? Submit a case.