Introduction & Executive Summary

In January 2024, Arizona Governor Katie Hobbs announced a budget plan to revoke scholarship opportunities from nearly 50,000 students utilizing the Empowerment Scholarship Account (ESA) program, in addition to eliminating aid to tens of thousands of additional students receiving financial assistance through the state’s School Tuition Organization tax credit scholarship program.[i]

Governor Hobbs’ office touted anticipated state savings from these efforts by shifting the financial cost of those students’ educations entirely to their families. Unfortunately, the governor’s proposal hinged upon the same logic held by other opponents of school choice: that certain families do not deserve financial assistance through the ESA program even as the state actively encourages them to instead enroll (at higher taxpayer cost) in the public school system.[ii]

This incongruity reflects a major discrepancy in the logic of anti-school choice activists. On one hand, they hold that scholarship assistance for children enrolled in private schooling options is too financially burdensome to the state. At the same time, however, they hold that taxpayer spending on children from families of identical wealth in the public school system is to be celebrated—if not increased.

Given the prevalence of political attacks made against the ESA program alleging that it siphons too much money to “wealthy” or “high income” families, this report reveals the disconnect between such rhetoric and reality. Specifically, Arizona taxpayers spend 10 to 20 times as much on “high income” families through the public school system as on the universal ESA program, and families pursuing private and homeschool education options in Arizona through the ESA or other means come in large numbers from all income ranges. Among other findings, this report documents the following:

- Over 80% of children from higher-income households enroll at taxpayer expense in public schools in both the United States overall and in Arizona.

- Arizona taxpayers spend $2 billion to $4 billion a year to subsidize public school instruction for children from households earning over $100,000.

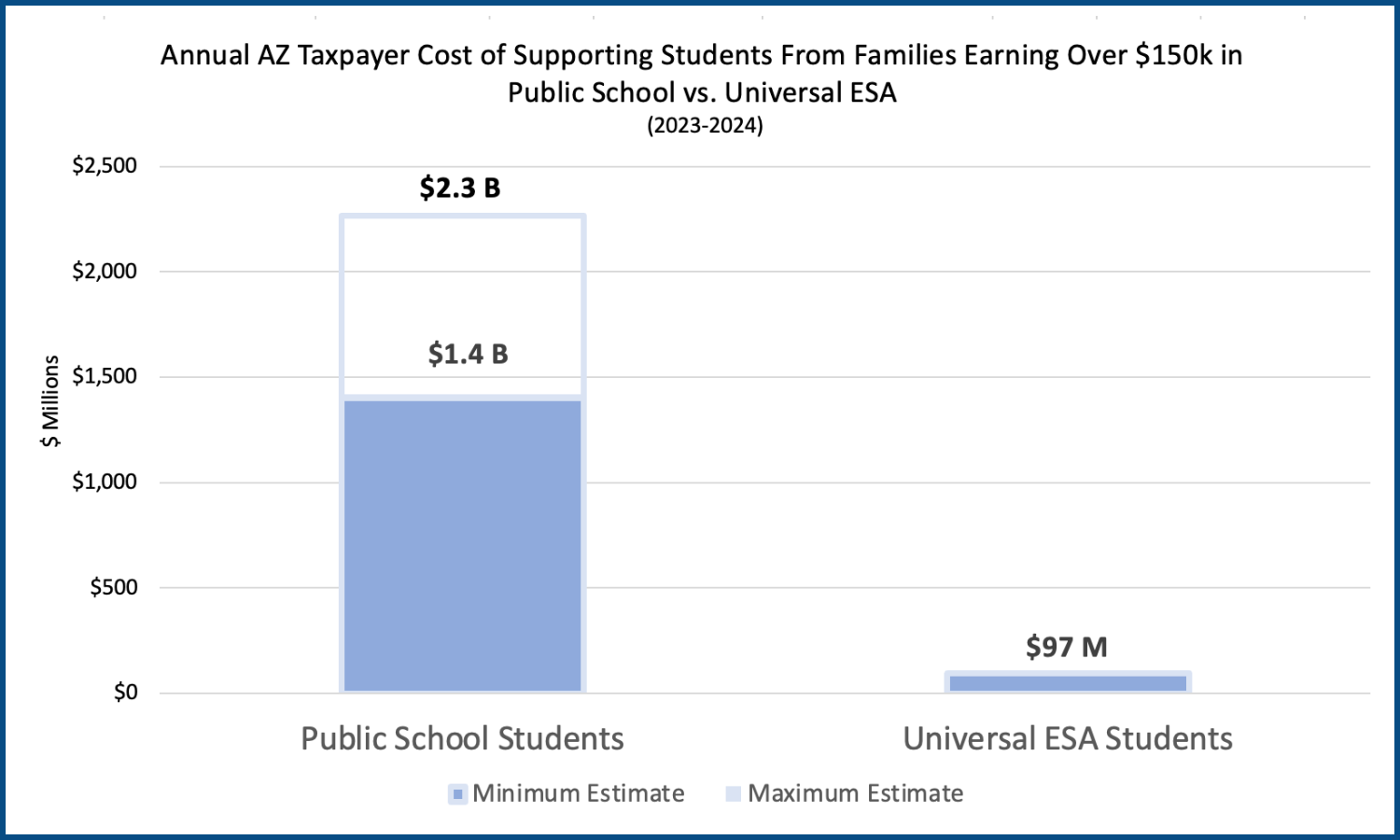

- Arizona taxpayers spend between 10 and 20 times more money subsidizing public school instruction for children from households earning over $150,000 than they do on similarly situated families who have joined the ESA program from a private or home-based school under universal expansion.

- Arizona taxpayers spend $1 billion to $2 billion a year to subsidize public school instruction for children from households earning over $150,000, compared with approximately $100 million for similarly situated universal ESA families.

- Contrary to erroneous media analyses, Arizona taxpayers spend more to educate virtually every single grade school student in the public school system than it would cost to educate that same student in the ESA program.

- ESA students are financially penalized under the current statutory framework, which requires them to forfeit their allocations of funding from the Classroom Site Fund and other state level per pupil funding measures.

Taxpayers Spend Dramatically More to Educate ‘Wealthy’ Students at Public Schools than at Private Schools

The overwhelming majority of “wealthy” families in the United States receive taxpayer-funded assistance through the public school system.

The U.S. Department of Education’s National Center for Education Statistics (NCES) reported in 2022 that 87% of children in households earning between $100,000 and $149,999 attend (at taxpayer expense) a public school, as do 80% of children in households earning over $150,000. Similarly, the NCES reports that among adults who whose households earn $100,000-$149,999 and have children in the home, 88% have at least one child attending public school, compared to just 11% with children in private school. Likewise among adults in households (with children) making over $150,000, 82% have a child attending public school at taxpayer expense, compared to 19% with a child in private school.[iii]

In short, the sheer volume of comparatively wealthy students and families availing themselves of public school at taxpayer expense dwarfs the number of similarly financially situated families pursuing private school.

Numerous states, including Arizona, reflect this same trend, as scholars such as Aaron Smith and Jordan Campbell of the Reason Foundation observed in 2023 based on data collected from the U.S. Census Bureau’s Household Pulse Survey between December 2022 and May 2023.[iv]

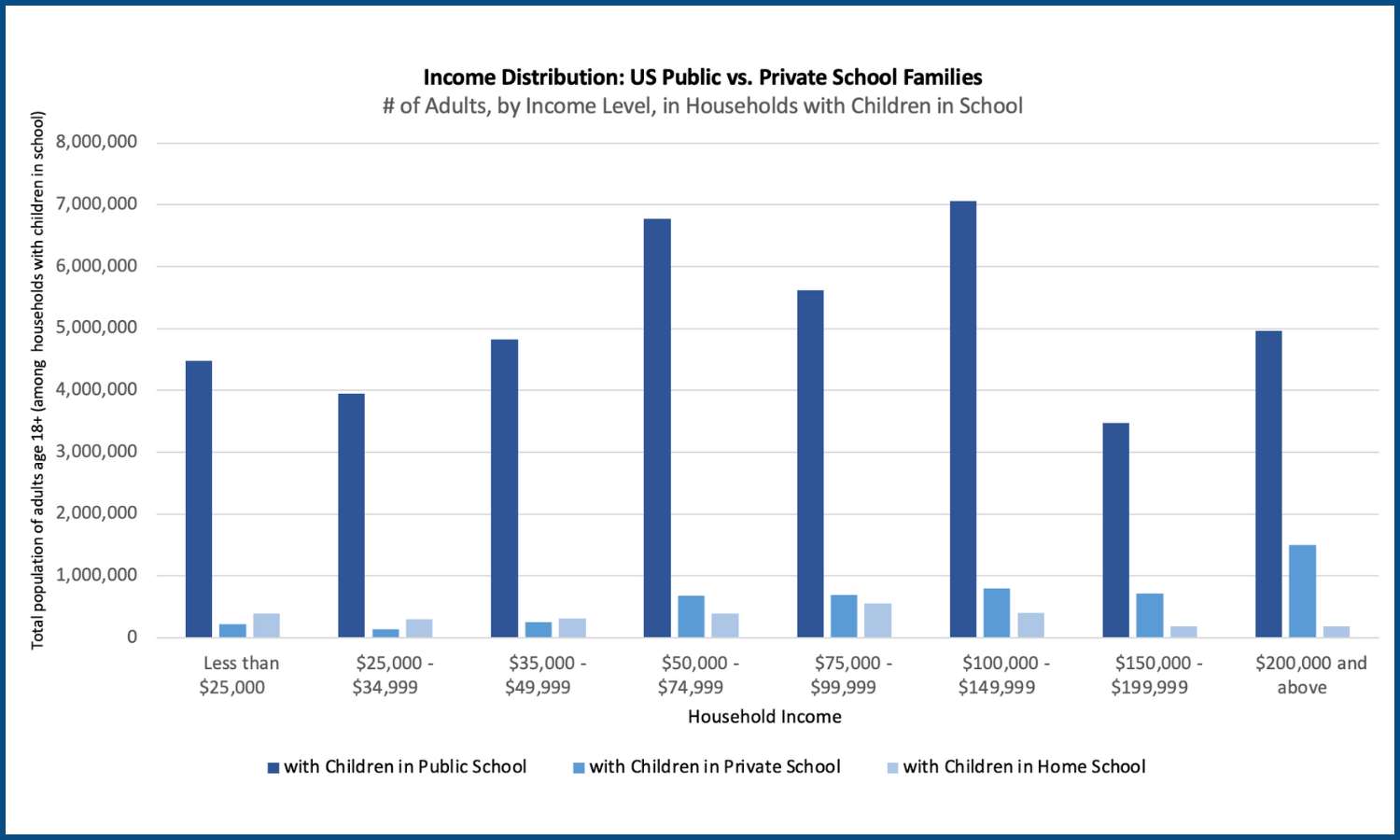

Building upon such prior analyses, this report utilizes the Household Pulse Survey Education Tables from five survey periods in 2023-2024 to illustrate the magnitude of taxpayers’ support for “high income” families through the public school system. Nationally, adults (among households with children in school) whose households earn more than $100,000 overwhelmingly reside with children who attend public school, as shown below in Figure 1. Likewise, among adults in households (with children) earning over $150,000, 80% reside with children in public schools, rather than private. And for those earning over $200,000 with children, over 75% reside with children in public—not private–school.

Figure 1

Source: U.S. Census Bureau: Phase 4.0, Cycle 03 Household Pulse Survey—March 5-April 1, 2024: “Table 1. School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics,” U.S. tab. Figures exclude households that did not report income.

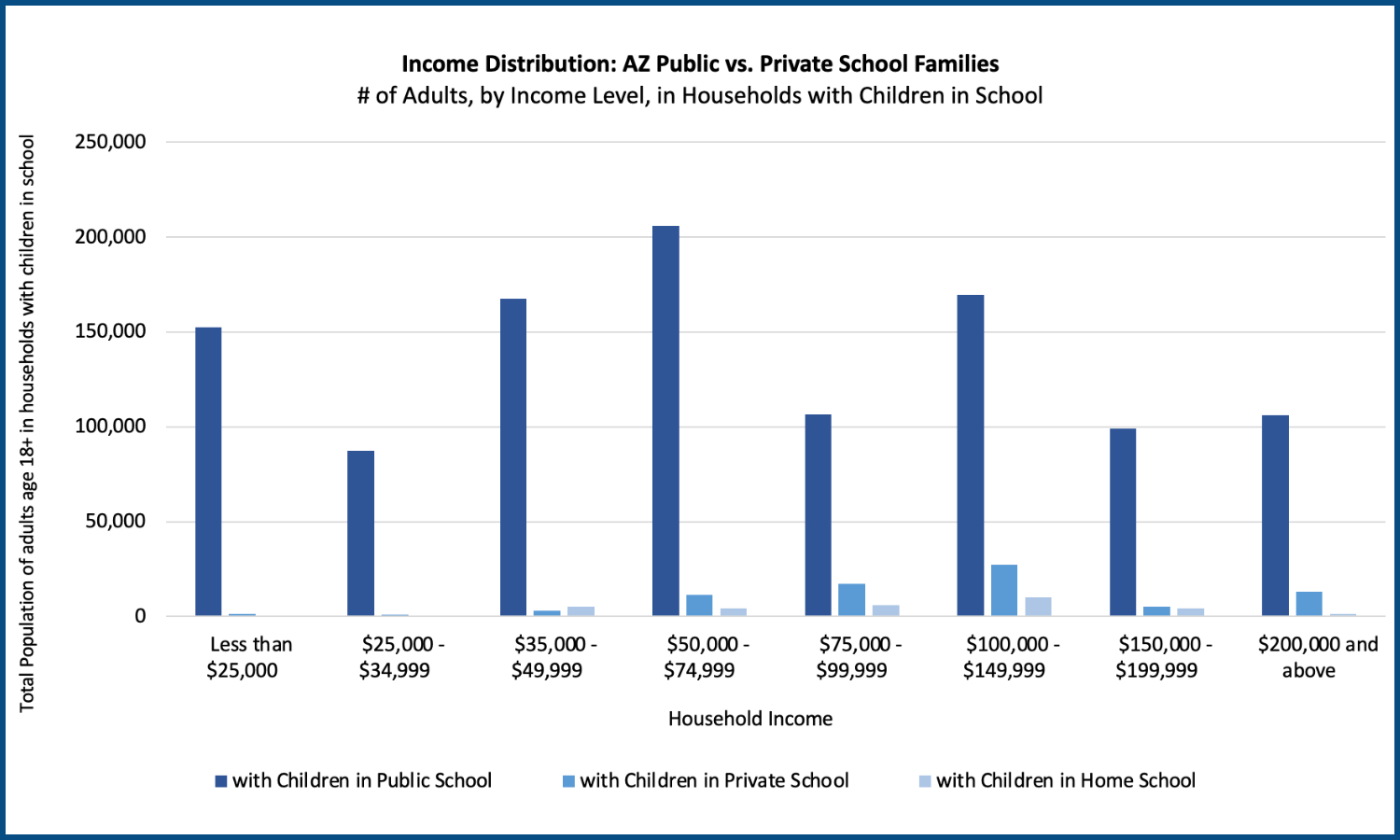

A similar pattern is present in Arizona as well, where an overwhelming majority of higher-income families enjoy educational services provided at taxpayer expense for their children via the public school system, as shown in Figure 2.

Figure 2

Source: U.S. Census Bureau: Phase 4.0, Cycle 03 Household Pulse Survey—March 5-April 1, 2024: “Table 1. School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics,” AZ tab. Figures exclude households that did not report income.

The relative magnitude of “high income” or “wealthy” families pursuing public vs. private education makes clear that public school families make up a vastly larger number of recipients of taxpayer-funded support than their private school peers both nationally and in Arizona. Of course, given the overall magnitude of public school enrollment across all income levels, it is also critical to examine the relative proportion of higher-income families using public vs. private education in Arizona.

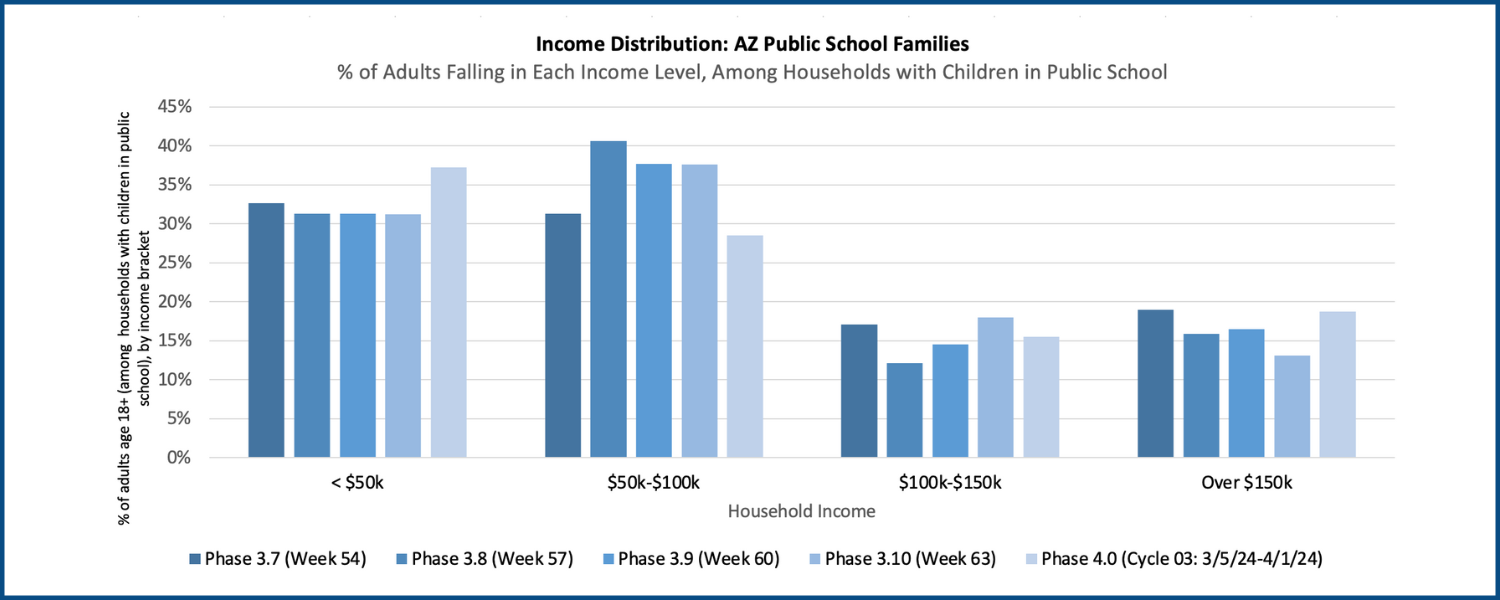

As the Census Bureau itself observes, data from the Household Pulse Survey can involve comparatively small samples sizes for certain subpopulations, which can result in larger standard errors in the estimates. To ensure more robust findings regarding the proportion of higher- and lower-income households associated with each type of schooling, this report draws upon five separate rounds of Census Bureau survey collections, specifically the last five phases of the Census Bureau’s Household Pulse Survey conducted in 2023 and 2024—including Phase 3.7 (Week 54), Phase 3.8 (Week 57), Phase 3.9 (Week 60), Phase 3.10 (Week 63), and the most recently released Phase 4.0 (Cycle 03), which was conducted between March 5 and April 1, 2024.

As shown in Figure 3, the income distribution among adults with public school children in the house is fairly consistent across all five waves: nearly one-third come from households earning over $100,000, of which roughly half come from households earning more than $150,000.[v]

Figure 3

Source: Analysis of U.S. Census Bureau Household Pulse Survey—Phase 3.7 (Week 54), Phase 3.8 (Week 57), Phase 3.9 (Week 60), Phase 3.10 (Week 63), and Phase 4.0 (Cycle 03): “School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics” Tables, AZ tabs. Proportions displayed above represent the share of adults (in households with children in public school) who fall within each household income bracket, as reported in each distinct survey wave. Figures exclude households that did not report income.

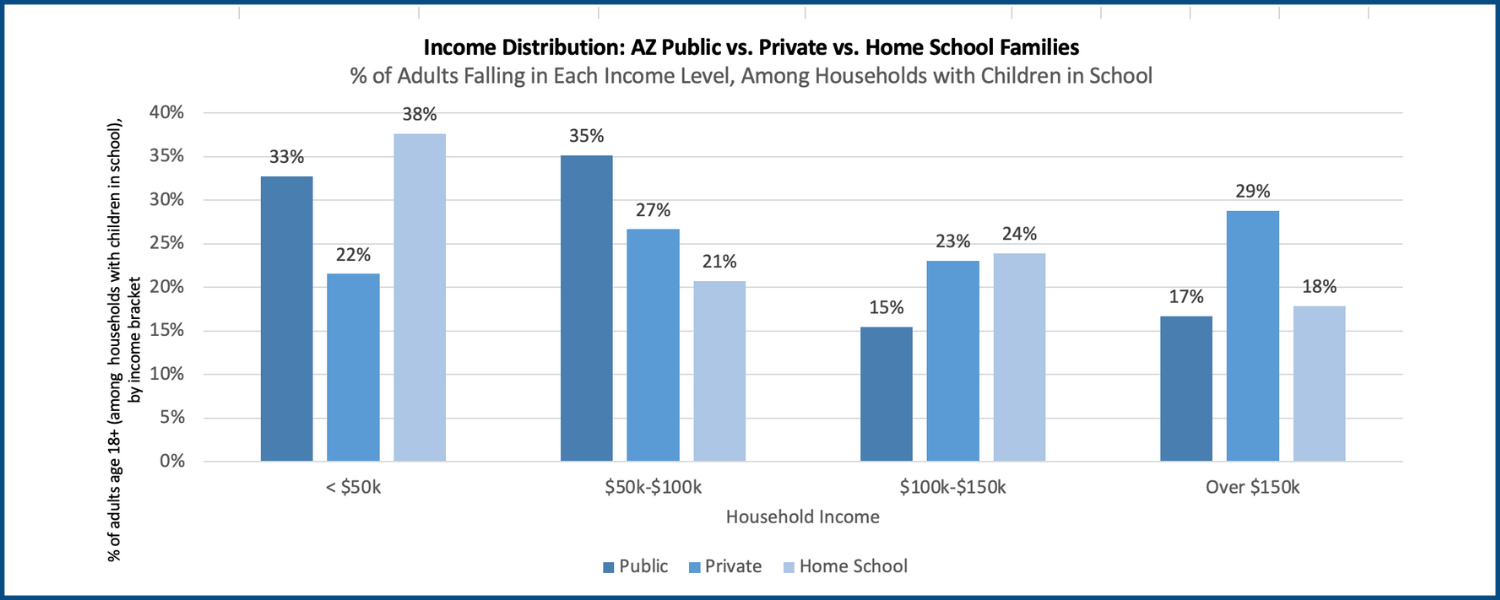

To better aggregate this data, Figure 4 likewise provides the proportion of adults (from households with children in school) falling into each income range, based on the average of the five survey waves for public, private, and homeschool families.

Figure 4

Source: Analysis of U.S. Census Bureau Household Pulse Survey—Phase 3.7 (Week 54), Phase 3.8 (Week 57), Phase 3.9 (Week 60), Phase 3.10 (Week 63), and Phase 4.0 (Cycle 03): “School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics” Tables, AZ tabs. Proportions displayed above represent the share of adults (in households with children in each type of schooling) who fall within each household income bracket, averaged across all five survey waves. Figures exclude households that did not report income.

This aggregated data suggests that approximately one-fifth of those associated with private school come from households with income less than $50,000, and that approximately half come from income levels less than $100,000. It likewise suggests that among those associated with homeschooling, nearly 60% come from household income levels less than $100,000. Among those associated with public school, nearly one-third come from households earning more than $100,000, including 17% coming from households earning above $150,000.

The aforementioned limitations around sample size and the experimental nature of the Census Bureau’s Household Pulse Survey mean that even these aggregated data provide only general approximations of the true income distributions among public, private, and homeschool populations in Arizona. However, the figures above broadly align with the U.S. Census Bureau’s own summary reports regarding household income distributions nationally. Specifically, in “School Enrollment in the United States: 2021, American Community Survey Reports,” the Census Bureau reports that the median household income of public school families in grades 1-12 ranged from $82,510 (grades 1-4) to $89,460 (grades 9-12) as of 2021, meaning that nationally, roughly half the population of public school households earned above these amounts.[vi] Given that Arizona’s median household income is narrowly below the national average,[vii] and the state’s child poverty rate (17.8%) is slightly above the national average (16.9%),[viii] it is no surprise that the state’s income distribution of public school families is shifted somewhat lower than the national average.

Public School Price Tag vs. ESA

As of the 2023-2024 school year, the absolute minimum formula funding for a full-time public school student is over $7,500 per pupil in Arizona (excluding all other formula multiplier weights, funding generated by district overrides, bonds, school facilities funding, etc., which together produce a total of over $12,200 in average per pupil costs to state and local taxpayers—and over $14,700 when including federal funds).[ix]

In Arizona, approximately 1.1 million students attend a public district or charter school statewide—at taxpayer expense.

Based on the Census Bureau’s Household Pulse income estimates above, if 17% of public school children statewide in Arizona hail from families earning over $150,000, that would translate to more than 185,000 students. At a minimum cost of $7,500 per student through the state funding formulas, this equates to over $1.4 billion in taxpayer support annually spent on the education of students from families earning over $150,000 a year through the public school system.

Moreover, if the estimated 32% of those coming from households (with children) making at least $100,000 a year were applied to the 1.1 million public school students, that would yield over 350,000 Arizona public school students at a cost of over $2.6 billion in formula funding.

In contrast, despite claims that the universal ESA expansion has siphoned dramatic amounts of funding to undeserving “wealthy” families, the total funding for similarly high-income students is a mere sliver of the total spent on their public school peers.

As of April 2024, over 77,000 students have joined the Arizona ESA program, including approximately 60,000 who have joined via the universal eligibility category.[x]

Of this latter amount, approximately 45,000 were not enrolled in a public school immediately prior—meaning they were previously homeschooled, enrolled in a private school, or had already switched from a public school in a prior year.[xi]

All other ESA students, by contrast, either attended public school immediately prior and were funded even more by taxpayers via the public school system, or joined the ESA program under the original eligibility criteria for groups such as students with disabilities or those coming from the foster care system or Native American reservations. Given that the leadership of even explicitly anti-ESA organizations such as Save Our Schools Arizona has declared, “We fully support the original ESA program,”[xii] the financial impacts of such students are not significantly in question.

Thus, it is the approximately 45,000 “universal” ESA students whom opponents might suggest are economically undeserving of aid through the program.

Yet based on the estimates from the Household Pulse Survey—suggesting that 29% of those from households with children in private school come from an income bracket above $150,000—this would indicate fewer than 15,000 such students. With a typical ESA award value of $7,400, this translates to less than $100 million in awards for such families, or roughly one-tenth the amount spent on similarly “wealthy” students in the public school system.

Actual Taxpayer Costs for ‘Wealthy’ Families Are Likely Even Higher

While the proportion of students in each income bracket is not strictly equivalent to the share of adults with children in those brackets (as reported in the Household Pulse Survey), the general income distribution of the latter provides a broad estimate of state spending on the former.

Moreover, the cost estimates in the preceding sections are based on extraordinarily conservative assumptions regarding the cost per public school student—excluding thousands of dollars of additional funding per pupil generated at taxpayer expense outside the basic formula. Indeed, applying the average—rather than minimum—state and local taxpayer cost per student of $12,200, the total spending on Arizona public school students from households earning over $150,000 would be over $2 billion a year, as shown in Figure 5. The total spending on public school students from households earning over $100,000 would exceed $4 billion a year.

To put it another way, when counting the full state and local taxpayer cost per public school student on average ($12,200), the amount spent on behalf of families earning over $150,000 would amount to roughly 20 times the total spent on similarly high-income students who have joined the ESA program from private or home-based schooling options under the universal expansion.

Figure 5

Source: Analysis of income distributions reported by U.S. Census Bureau Household Pulse Survey—Phase 3.7 (Week 54), Phase 3.8 (Week 57), Phase 3.9 (Week 60), Phase 3.10 (Week 63), and Phase 4.0 (Cycle 03): “School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics” Tables, AZ tabs, multiplied by Arizona public school total average daily membership (ADM) as reported by Joint Legislative Budget Committee or multiplied by total population of ESA students joining under “universal” expansion eligibility criteria not previously enrolled in a public school in the prior year. Population amounts multiplied by minimum Arizona public school per pupil variable cost of $7,500 (minimum estimate), average state and local taxpayer cost of $12,200 (maximum estimate), or typical ESA award value of $7,400 (ESA estimate), as applicable.

Given the nature of the Census Bureau’s Household Pulse Survey data—drawn from a weighted sampling of households rather than a full census of all students—and given that its data tables record the income distribution of adults in households with children (rather than children directly themselves) such estimates provide only general approximations of the actual income distribution of students in public schooling vs. private education. For instance, variation in the share of public vs. private school households in each income bracket with one vs. two parents could further adjust the relative proportions of estimated students in each bracket. However, based upon other independent analyses, such as that of the Common Sense Institute’s 2024 report “Growth & Change—One Year of ESAs,” the amounts displayed in this report appear likely to underestimate the share of public school households earning over $150,000 while overestimating the share of ESA families in that income bracket for reasons, as discussed above, such as the inclusion of home-based learning families in the ESA program, who tend to earn lower household incomes than their private school peers.[xiii]

Critics’ Objections Are Intellectually Inconsistent

Proponents will note that spending on “wealthy” students in the public school system goes to the public school at large, which aggregates its funding for students of all income backgrounds together. However, this argument does little to resolve the inconsistency of their argument for several reasons. First, private schools also serve a mix of both high- and low-income students. (As highlighted in a previous Goldwater report, for example, Arizona’s corporate tax credit scholarship program serves almost exclusively lower-income students in private schools. The Brophy Community Foundation, for instance—associated with Brophy College Preparatory, one of the highest academically performing private high schools in the state, where tuition and fees exceed $18,500—reports that the average family income of recipients who received tuition assistance in 2022-2023 was $45,500.)[xiv] Any argument made in favor of paying for “wealthier” students at a public school to support the well-being of all attending students would thus apply to the private school sector as well.

In addition, when it comes to funding higher-income students in the public school, the state is being charged specifically for those students, whose collective presence in the public school system does add significant cost to the public school system: both variable and fixed costs, including the necessity to hire additional staff or construct or renovate for larger campuses.

Moreover, the ESA population consists of a significant number of students served by home-based learning. As shown in the Household Pulse Survey data, homeschool families tend to enjoy lower household incomes than families choosing private school, meaning that the true proportion of ESA families in the highest-income bracket is likely even lower than the estimates used in this report.

(The comparatively lower average income among homeschool families follows almost by definition given that at least one of the potential earners in the family has forgone full-time earnings outside the home, leading more often to reliance on a single income).

As revealed by Governor Hobbs’ fiscal year 2025 budget proposal—in which students were threatened with removal from the ESA program ostensibly for budgetary reasons—those same students were implicitly encouraged to enroll in a public school for 100 days (enough to generate funding for their local public school), further casting doubt that the underlying concern is affordability rather than opposition to nonpublic schooling.

Lastly, it is true that the Arizona Constitution requires the provision of free public schooling open to all students regardless of income, but it does not mandate such access to students participating in the ESA program. Yet this again has little bearing on the actual fiscal burden on taxpayers of each, and just as opponents of the ESA program seek to alter statute to remove ESA access, so too could voters amend the state constitution to establish such legal parity.[xv]

Public School is the Costlier Option for Virtually Every Child

In addition to an uneven playing field under the state constitution, the ESA program also faces a related disadvantage. Its students receive less financial support from Arizona taxpayers than they would if they were enrolled in the public school system, regardless of their family income. Indeed, contrary to erroneous media analyses, Arizona taxpayers spend hundreds—if not thousands—more to educate virtually every single grade school student in the public district school system than it would cost to educate that same student each year in the ESA program.

As highlighted in a prior Goldwater Institute report, as of the 2023-2024 school year, the estimated average cost to Arizona taxpayers per public school student is $12,211 (through state and local taxes alone, even excluding what Arizonans pay in federal taxes), compared to the median ESA award cost of $7,400. Even using the average—rather than median—ESA cost in order to account for special education ESA students, the total cost per child remains thousands of dollars less than the public school system. [xvi]

Despite this, media outlets such as NBC’s 12News have repeatedly and erroneously branded similar statements as false. For example, the news outlet’s fact checkers claimed that the following statement by Arizona Speaker of the House Ben Toma was untrue:

“For every child that switches from a traditional charter or a traditional district school, by in large, most district schools, the state actually saves money for every child that switches over to an ESA.”

Indeed, as NBC’s Joe Dana attempted to argue in 2024, Arizona’s public school funding formulas “include many fixed costs that Toma and Republican lawmakers do not account for,” while citing estimates showing a roughly $500 higher state General Fund cost for each child enrolled in the ESA program rather than a district school.[xvii]

Unfortunately, such analyses arbitrarily omit other massive sources of state funding for public school students that ESA participants do not receive. For example, the state’s Classroom Site Fund alone generates over $1 billion annually (nearly $1,000 per student) primarily from a state sales tax surcharge paid by virtually all state residents.[xviii] This funding is allocated on a purely per pupil basis to each public school based upon student enrollment.

Every ESA student who opts out of or switches from a school district to an ESA forfeits their share of this funding entirely, and it is redirected back to the funding of students still in the public school system. Suggesting that this funding is not a cost to the state or state taxpayers is a significant misrepresentation of the cost of the Arizona public school system. Moreover, when it is included in the overall comparison of district and ESA funding per child, it results in an overall net savings of several hundred dollars of funding at minimum, even before taking into account the billions of dollars of various other “fixed” and “variable” costs placed on state taxpayers by the public school system, including bonds and “overrides.”

Indeed, to the extent that such funding sources are ignored by ESA opponents in the media because they are separate from the state General Fund or because the amount levied for them via tax surcharges is independent from the number of students, such critics should have no objection to allowing ESA students a share of this funding as well. Specifically, policymakers might consider amending statute to allow a portion of future growth in the Classroom Site Fund revenues to supplement ESA awards, as this would—by critics’ own logic at least—cost the state no additional money per student, nor reduce the amount of state funding received by school districts per child.

Such a policy adjustment would not only help close the gap between ESA families and their public school peers, it would further reinforce the ESA program’s ability to serve all families across the economic spectrum, just as the Classroom Site Fund monies are currently being used in the public school system to serve lower, middle, and high income families alike.

Conclusion

Definitions of “low income,” “middle class,” or “high income” are inherently contestable. But regardless of the specific cutoffs one uses, such standards should be applied logically and consistently. Unfortunately, while opponents consistently seek to portray Arizona’s ESA program as an unaffordable giveaway to “the wealthy,” data suggests that regardless of the cutoff used for “middle” or “high” income, such critics should look first at the far larger infusion of taxpayer resources poured into similarly “wealthy” families enjoying taxpayer-funded instruction via the public school system.

Indeed, as this report makes clear, the specific amounts may vary and available data may give only rough approximations of the actual income distributions of families with children in public and private school, but the numbers strongly suggest that the same arguments leveled against the ESA program apply far more significantly to public schools as well.

While more robust datasets than the Census Bureau’s Household Pulse Survey may further illuminate the overall financial profile of those choosing public schooling vs. an ESA, policymakers and the public should continue to seek to maximize educational opportunity for all, regardless of the form a particular family chooses to exercise. Just as Arizona’s public charter schools serve students from all income backgrounds and now outperform the state’s public school districts in both academics and cost,[xix] so too does the ESA program offer families the chance to pursue the best educational choice for their child, regardless of economic background.

Policymakers and the public should celebrate this new reality, not contort themselves into intellectually inconsistent positions for the sake of political aims. Arizona students—of all types—would be better off for it.

End Notes

[i] State of Arizona Executive Budget Summary, Fiscal Year 2025, Katie Hobbs, January 2024, https://www.azospb.gov/Documents/2024/FY%202025%20Summary%20Book.pdf.

[ii] Under Governor Hobbs’ budget proposal, “students receiving [an ESA] must have previously attended a public school for at least 100 days at any point during their K-12 education.” This makes clear that a student’s eligibility for the ESA program would be determined solely based on whether that student first attended a public school.

[iii] Table 206.60. “Among adults 18 years old and over who had children under 18 in the home, percentage reporting having at least one child enrolled in public school, enrolled in private school, or homeschooled, and percentage distribution of children by type of schooling, by selected adult and household characteristics: 2020-21,” U.S. Department of Education National Center for Education Statistics, February 2022, https://nces.ed.gov/programs/digest/d21/tables/dt21_206.60.asp.

[iv] Aaron Smith and Jordan Campbell, “Homeschooling Is on the Rise, Even as the Pandemic Recedes,” Reason Foundation, May 31, 2023, https://reason.org/commentary/homeschooling-is-on-the-rise-even-as-the-pandemic-recedes/.

[v] “Table 4. School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics,” Week 54 Household Pulse Survey: February 1-February 13, 2023, U.S. Census Bureau, https://www.census.gov/data/tables/2023/demo/hhp/hhp54.html; “Table 4. School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics,” Week 57 Household Pulse Survey: April 26-May 8, 2023, U.S. Census Bureau, https://www.census.gov/data/tables/2023/demo/hhp/hhp57.html; “Table 1. School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics,” Week 60 Household Pulse Survey: July 26-August 7, 2023, U.S. Census Bureau, https://www.census.gov/data/tables/2023/demo/hhp/hhp60.html; “Table 1. School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics,” Week 63 Household Pulse Survey: October 18-October 30, 2023, U.S. Census Bureau, https://www.census.gov/data/tables/2023/demo/hhp/hhp63.html;

“Table 1. School Enrollment Type for Children in Kindergarten to Twelve Grade, by Select Characteristics,” Phase 4.0 Cycle 03 Household Pulse Survey: March 5-April 1, 2024, https://www.census.gov/data/tables/2024/demo/hhp/cycle03.html.

[vi] Jacob Fabina, Erik L. Hernandez, and Kevin McElrath, “School Enrollment in the United States: 2021,” American Community Survey Reports, U.S. Census Bureau, June 2023, https://www.census.gov/content/dam/Census/library/publications/2023/acs/acs-55.pdf.

[vii] Kirby Posey, “Household Income in States and Metropolitan Areas: 2022,” Table 1: Median Household Income and Gini Index in the Past 12 Months by State and Puerto Rico: 2021 and 2022, U.S. Census Bureau, December 2023, https://www.census.gov/content/dam/Census/library/publications/2023/acs/acsbr-017.pdf.

[viii] U.S. Department of Agriculture, USDA Economic Research Service, “Percent of Total Population in Poverty, 2021,” https://data.ers.usda.gov/reports.aspx?ID=17826.

[ix] Minimum $7,500 amount includes only the statutorily prescribed Base Level amount, minimum possible Group A multiplier, Classroom Site Fund, Instructional Improvement Fund, district additional assistance, and statutorily prescribed per pupil state aid and Prop 123 supplemental funding, excluding all other state and local funding sources. Reported average funding from all state, local, and federal funding as reported in “K-12 Funding (M&O, Capital and Other), FY 2015 through FY 2024 est, All Funding,” Arizona Joint Legislative Budget Committee, August 9, 2023, https://www.azjlbc.gov/units/allfunding.pdf, accessed April 27, 2024.

[x] As of December 31, 2023, 54,028 universal ESA students and 17,492 students qualifying under pre-universal expansion criteria were enrolled in the program as reported in “Fiscal Year 2024 Quarter 2 Report to Arizona State Board of Education,” Arizona Department of Education, April 23, 2024, https://www.azed.gov/sites/default/files/2024/04/Q2%20FY2024%20ESA%20Report_SBE.pdf. Total ESA enrollment as reported by the Department of Education as of April 22, 2024: 77,249, indicates up to 6,000 additional universal ESA students having joined in quarters 3 and 4 of school year 2023-2024.

[xi] “Arizona Empowerment Scholarship Account (ESA) Program,” Fiscal Year 2024 Quarter 2 Report

Pursuant to Arizona Revised Statutes § 15-2406, February 27, 2024, https://www.azed.gov/sites/default/files/2024/02/FINAL_ESA%20Draft_Governors%20Report%201.11.24%20copy%20secured%202.pdf.

[xii] “Arizona State Board of Education Board Meeting,” YouTube video, 4:11, February 27, 2023, https://youtu.be/P9id-Mue1ck?t=4922.

[xiii] Glenn Farley, “Growth & Change: How One Year Of Universal Empowerment Scholarship Accounts Has (And Hasn’t) Altered Arizona’s K-12 Landscape,” Common Sense Institute Arizona, April 2024, https://commonsenseinstituteaz.org/wp-content/uploads/2024/04/CSI_REPORT_ESA_GROWTH_APRIL_2024.pdf.

[xiv] Matt Beienburg, “Universal Opportunity: How Arizona’s Empowerment Scholarship Accounts (ESA) Defied Critics and Unleashed Affordable Private Education for All, Part I,” Goldwater Institute, January 22, 2024, https://www.goldwaterinstitute.org/policy-report/universal-opportunity/#_edn10.

[xv] Arizona Constitution, Article XI, Section 6, https://www.azleg.gov/viewDocument/?docName=https://www.azleg.gov/const/11/6.htm.

[xvi] Beienburg, 2024.

[xvii] Joe Dana, “Verify: Are ESA savings claims by AZ Speaker Toma and Republicans True?” 12News, January 19, 2024, https://www.12news.com/article/news/verify/verify-esa-funding-taxpayer-savings/75-d06875fe-a6ef-4461-9558-3ab971f18b9b.

[xviii] “Estimated Classroom Site Fund Per Pupil Amount for FY 2025,” Arizona Joint Legislative Budget Committee, March 28, 2024, https://www.azjlbc.gov/units/csf-fy2025032824.pdf.

[xix] Matt Beienburg, “New Study: AZ Students Learn More in Charter Schools Than Districts,” Goldwater Institute, June 8, 2023, https://www.goldwaterinstitute.org/new-study-az-students-learn-more-in-charter-schools-than-districts/.