Matt Beienburg is the Director of Education Policy and the Director of the Van Sittert Center for Constitutional Advocacy at the Goldwater Institute. Jim Rounds is a Senior Fellow at the Goldwater Institute and the President of Rounds Consulting Group.

Executive Summary

Arizona embodies the very best of America’s political and economic traditions, from limited and responsive government to thriving entrepreneurship and innovation. Thousands choose the state as their new home each year to escape the economic stagnation and out-of-control tax and regulatory burdens of California and the Northeast.[i]

Yet now as the state seeks to recover from the massive economic distress of COVID-19—which tore through the American economy, devastated small businesses, and triggered unemployment levels not seen since the Great Depression—activists under the banner of “Invest in Education” have doubled down on a plan to weaken the state’s economic prospects.

Indeed, bankrolled by out-of-state interests and pushed by the state’s largest teachers union, the so-called “InvestinEd” proposal aims to dramatically raise the top marginal individual income tax rate in Arizona. There are many reasons why this is not the right plan and why the proposal comes at the wrong time.

Proponents of InvestinEd (or Proposition 208, as it will appear on the ballot) have suggested their plan will affect only the wealthiest Arizonans and claimed—perhaps even more audaciously—that a tax increase will actively help Arizona’s economy.[ii] Yet as made startlingly clear in the following pages, the initiative would burden far more than simply high-earning individuals—it would wreak economic harm upon Arizonans of all income levels in every industry in the state.

This report documents the projected economic fallout of Prop. 208, including job losses, suppressed wage growth, dampened business recruitment, and harm to the state’s current economic base. In particular, economic modeling shows that with the passage of Prop. 208, we can expect the following:

- Job losses will reach a minimum of 124,000 by the 10th year of implementation—four times greater than the losses experienced during the economic downturn of 2001. Far from affecting only high-income earners, the initiative will jeopardize the employment of thousands of plumbers, dry cleaners, nurses, retail store employees, mechanics, janitors, and others throughout the state.

- A minimum of $2.4 billion in state and local tax revenues will be lost over the same period. The economic losses will be the result of a reduction in business recruitment, job growth, and wages, as well as an erosion of the current economic base.

- State General Fund revenues will lose at least $120 million per year, resulting in cuts to other government services. The initiative requires any decrease in state revenue to be made up by cutting from other sources, such as child protective services, public safety, and higher education.

- Fifty percent of those whose tax rates will be directly targeted will be small business owners. These individuals represent thousands of job creators and will bear a disproportionate load from the InvestinEd price tag.

Importantly, while the economic modeling behind this report analyzed multiple potential economic scenarios, only the most (overly) conservative—and favorable to Prop. 208—scenario is presented here.

Moreover, the projected cumulative effects do not include the likely reduction in wages for newly created jobs, nor the likely flight of high-income individuals from Arizona that Prop. 208 would trigger by its near doubling of their top marginal tax rate. In other words, as severe as the estimated effects appear to be in this report, it is highly probable that the actual effects of Prop. 208 will be even more extreme.

Introduction

In 2018, the Arizona Supreme Court struck down the first iteration of the InvestinEd ballot initiative, noting that “it imposes tax increases on most Arizona taxpayers rather than only the state’s wealthiest taxpayers” as claimed by its proponents in the official ballot summary language they produced.[3]

Fewer than two years later, the organizers behind InvestinEd have returned to Arizona voters with the same core proposal in Prop. 208—increasing spending on the state’s K-12 system by dramatically increasing the state’s top marginal individual income tax rate (increasing it by 78%).[4] While the initiative’s modified language no longer directly raises tax rates on all Arizonans, its economic impact upon their livelihoods will be no less severe than under the previous proposal.

The review of Prop. 208’s impact includes econometric modeling, interviews, research, and fiscal impact analyses. Together, these methodologies allow for an approximation of the potential job losses and the changes in income and business sectors that would ultimately be affected by Prop. 208. Importantly, the projected impacts are intended to estimate the dynamic economic and fiscal losses that might occur under Prop. 208’s less competitive individual income tax rates. (In contrast to “static” economic models, “dynamic” models of this sort account for changes in the behavior of individuals and businesses when facing new circumstances.)

Basic Economic Inputs and Considerations

There are several ways the initiative could damage the state’s economy, including reduced attractiveness to businesses locating from other states, slower annual job growth, lower wages for newly created jobs, and the erosion of the state’s “economic base.” Additionally, the initiative could lead to the exodus of high-income individuals and business owners (including their employees) to more tax-friendly states.

Prop. 208 Flashes a Red Light to New Business Attraction and Development:

Regarding the first of these effects: interviews with economists, economic development professionals, and site selectors identified the risk to new business attraction and expansion could be as large as a 25% reduction.[5] However, only a 15% reduction was used in the analysis. The reduction in business attraction is exacerbated by the fact that each lost base-sector job also results in the loss of an additional one to two supplier jobs.

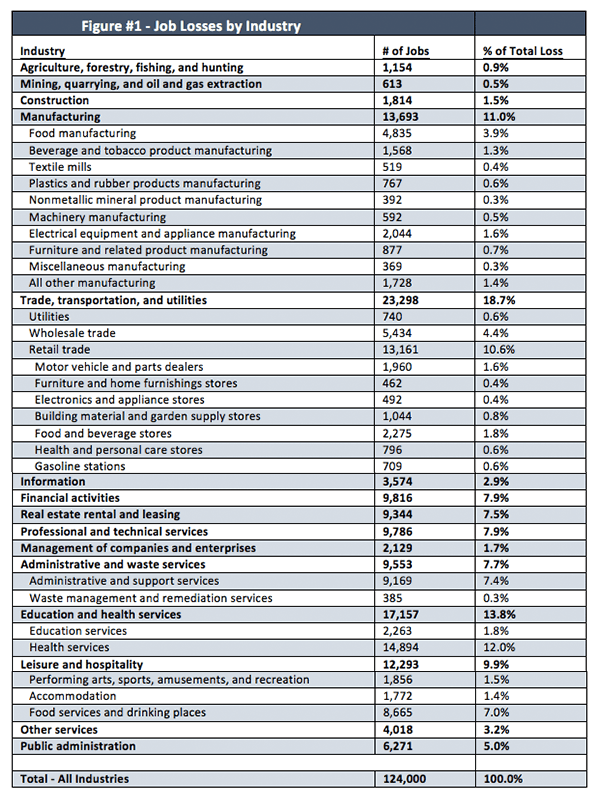

These lost supplier jobs represent employment in every industry, from restaurants and bars to manufacturing and construction. Thousands of plumbers, dry cleaners, nurses, retail store employees, mechanics, janitors, etc., would therefore be at risk of losing their jobs. This means the initiative would affect Arizonans across the board, not just high-income individuals (see Figure 1).

Contributing to this problem, Prop. 208 will immediately eliminate Arizona from consideration among many businesses that conduct a comparative analysis of top marginal tax rates when determining where to locate. Top marginal tax rates are the easiest and most common metric to compare when performing competitiveness assessments because other measures like “effective tax rates” (the percentage of an individual’s taxable income paid in taxes) are very difficult to calculate and vary from person to person and business to business. Therefore, a state’s effective individual income tax rate will not make any lists, but a top marginal income tax rate of 8% would put Arizona in the bottom 10 states.

Prop. 208 Will Harm Economic Growth:

Even beyond the loss in business recruitment, the initiative is expected to have a negative impact on the state’s ability to grow the current “economic base”—those businesses and employers that help establish a community’s economic foundation. Arizona’s long-run rate of job growth (currently forecasted to be 1.7%) will slow by 0.1 to 0.3 percentage points (i.e., to 1.6% or 1.4%). Again, only the lower end of the estimated range was used in the calculations. This appears to be an overly modest adjustment, but it results in significant economic and fiscal losses over time. (While marginal downtrends in economic growth may appear small on their own, they accumulate quickly. This is similar to how compound interest works, but we can instead label it as “compound economic development erosion.”)

Additionally, the initiative will erode the statewide average income as fewer high-wage jobs will be created. Although the initial decrease in average incomes are forecasted to be minor (only $100 to $200 in year one), in 10 years the marginal difference decreases the statewide average income between $1,000 and $2,000 compared to the previous base.

Monetizing the Key Economic Losses of Prop. 208

Dampened Business Recruitment and Expansion:

In any given year, Arizona has a net positive employment growth rate. The state typically adds new jobs while losing a much smaller percentage as people retire or leave the state. Furthermore, aggressive marketing and economic development efforts generate recruitment and expansion opportunities that are added to the natural rate of job growth.

On average, an estimated 20,000 to 30,000 new jobs are recruited into the state each year through targeted marketing and economic development efforts.[6] As described above, interview feedback suggests there will be at least a 25% reduction in new business recruitment under Prop. 208 (with each forgone base-sector job costing an additional one to two supplier jobs). Even assuming a much more conservative recruitment loss rate of 15% and applying the reduction to the lower 20,000 annual business recruitment figure, the resulting impact of the ballot measure would be severe.

In financial terms, at a 15% annual reduction in new economic development activity, Arizona would lose 63,000 jobs and $1.1 billion in state and local tax collections over the first 10 years, from this aspect of the initiative alone.

Slower Job Growth:

As outlined above, the current forecast for statewide job growth over the next decade is 1.7% per year. If this rate of job growth were to slow by just 0.1 percentage point (i.e., drop from 1.7% to 1.6%) over 10 years, Arizona would lose another 36,000 jobs and $600 million in state and local tax collections.

Erosion of Arizona’s Current Economic Activity:

Finally, after accounting for the above specific economic drags on growth, the economic modeling recognizes Prop. 208’s broader impact of reducing the state’s current economic base by some marginal amount (that is, its impact on existing wages and employment). Projecting even a very slight reduction to the average statewide wage—$100 per year at implementation, escalating to $1,000 per year by year 10—the economic analysis finds the further erosion of 25,000 lost jobs over a 10-year period and fiscal losses at the state and local level of $650 million.

Additional Economic and Fiscal Impacts:

As previously noted, the goal was to display the economic effects from Prop. 208 through the use of highly conservative figures. Items that were calculated but not summarized in the overall economic impact estimates include the likely reduction in new business development wages, as well as the full impact of the out-migration of millionaires that will seek residency in a more tax-favorable state (a portion of this is already captured in the impact on state wages).

For context, if, as projected, Prop. 208 leads to a reduction in the quality and wages of new jobs created, the fiscal impacts will be magnified even further. As of 2019, the average annual wage in Arizona totaled approximately $54,000.[7] If the level of wages for new jobs is eroded by just $1,000, another 2,700 jobs would be lost over 10 years as well as $80 million in state and local tax collections.

The Whole Is Worse than the Sum of the Parts: The Cumulative Impact of Prop. 208

Each of the individual effects above suggests significant long-term economic harm from the passage of Prop. 208. However, it is only when all of the components are added together that the full weight of Prop. 208 can truly be grasped. Indeed, after combining each of the (overly conservative) estimates above, the cumulative job losses from Prop. 208 would reach 124,000 over 10 years. Likewise, the lower-end estimate of state and local tax collection losses over the next decade sums to $2.4 billion.

Out-Migration of High-Income Individuals:

As substantial as the aforementioned damage is projected to be, the economic modeling does not account for a number of other harms likely to result from Prop. 208, which could exacerbate its economic costs even above the projected totals. For example, as observed by the Arizona Joint Legislative Budget Committee in its own analysis of Prop. 208, multiple academic studies have documented the risk of high-income earners leaving a state in response to dramatic increases in a state’s top marginal tax increase. [8]

This is an especially significant risk to Arizona because migration data over the past four years shows that thousands of people are fleeing high-tax states to those with lower tax burdens. In fact, the states with the largest tax burden lost nearly 600,000 households and over $33 billion in aggregated income in 2016 alone.[9] If Prop. 208 were to pass, Arizona would have one of the highest top marginal income tax rates in the country, on par with New York and significantly higher than all of the surrounding states (with the lone exception of California).

Since Arizona already imposes a disproportionately high sales tax rate compared to most states, inflicting an equally high income tax rate would make Arizona one of the least desirable states in the country in terms of overall tax burden. Similar to what has happened in California and New York, this would virtually ensure a mass exodus of residents and businesses from the state.

The economic impact that would result from these high-income individuals leaving the state and taking their employees with them are not currently factored into the fiscal impact estimates above, making the projected totals even more conservative.

Prop. 208 and the Magnitude of a Recession

The projected loss of over 100,000 jobs over the next decade highlights the extraordinary economic damage likely to result from Prop. 208. Yet as alarming as this figure is by itself, it is perhaps even more worrisome when considered in context. Consider, for example, that during the Great Recession, the state lost approximately 300,000 jobs, and that the current COVID-19 recession has cost Arizonans approximately that same number. The more typical 2001 recession, in contrast, resulted in the state losing 30,000 jobs.[10]

Thus, the conservative estimate of 124,000 lost jobs resulting from the initiative through just the first 10 years of implementation is equivalent to nearly half of the losses realized during the last two incredibly severe recessions (Great Recession and COVID-19 recession), and is four times greater than the more typical downturn of 2001.

In essence, the initiative is a measure to permanently change economic conditions equivalent to an ongoing economic downturn in the state. Moreover, it is worth remembering that these numbers were derived from overly conservative estimates. The same economic modeling when using more aggressive but reasonable inputs produced job and tax revenue losses more than double what is displayed in this report.

No Industry Left Untouched by Prop. 208

Unfortunately, this downturn will not be isolated to a mere sliver of Arizona’s population, nor limited in its reach to any particular income level or industry. A second economic and fiscal impact model was separately created to estimate the job losses by industry that would result from the overall 124,000 estimated job losses. As shown in Figure 1, these job losses are projected to impact virtually every industry in the state, with manufacturing, retail, and health and food services hit especially hard. Moreover, the job losses within these calculations primarily reflect impact on small businesses.

Prop. 208 Will Sacrifice Small Businesses

One of the most significant aspects of Prop. 208—and among the most inconvenient to its proponents’ narratives—is the measure’s outsize impact upon small businesses. Indeed, while its supporters have sought to cast the measure as a tax only upon well-to-do individuals, the evidence suggests that small businesses will bear a disproportionate share of the initiative’s costs. While a poor policy prescription at any point, this is particularly troubling in the wake of the COVID-19 pandemic, during which more than 100,000 small businesses have permanently closed across the nation.[11]

An analysis of IRS data—supplemented by additional modeling and adjustments to identify only those Arizona taxpayers directly affected by the rate increase—reveals an estimated 90,000 Arizona tax filers who will be affected. Of these, more than 50% would be small business owners. These filers, categorized into one of two groups—either one-person businesses or businesses with at least one employee—would thus shoulder an inordinate amount of the increased tax burden.

This burden is made especially acute by the fact that small business owners get the last—rather than the first—dollar earned if the business is profitable. Unlike a salaried employee who receives a steady paycheck, small business owners have no such guarantee of earnings in a given year. Moreover, small business profits in one year are often reinvested in the business, but each additional dollar paid in taxes is one less dollar available to pay for labor and capital reinvestment.

Keep in mind that the small business owner is not only the last person paid, but serves many roles, including president and CEO, board of directors, human resources department, and sometimes janitor. The owner is the business. Arguments that attempt to separate the business owner from the business operations are misleading and formulated by those who have not actually operated a small business.

Prop. 208 Relies on Politically Expedient, Economically Divisive Scapegoating

While the job losses and other economic harms resulting from Prop. 208 will be borne by Arizona workers at all levels, it is true that the initiative’s proponents have sought to target its explicit costs upon one group of Arizonans in particular: residents with higher taxable incomes.

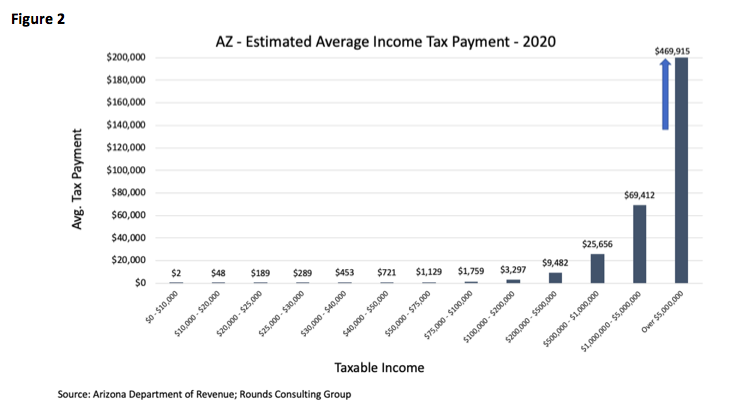

This strategy is perhaps appealing to those unaware of the cascading economic effects of Prop. 208, but in reality, higher-income small business owners (and all higher-income tax filers) already pay far more in taxes than lower-income filers. As reported by the Arizona Department of Revenue, for example, Arizona tax filers making over $200,000 represent less than 5% of Arizona’s population, yet they already shoulder 40% of the income tax liability in Arizona. (That number rises to almost 66% when including filers above $100,000.)[12] Indeed, as Figure 2 shows, filers in the lowest income brackets (below $40,000) pay between $2 and $453 in state taxes on average, while those in the highest brackets pay nearly $470,000 or more per year.

Additional Hazards of Prop. 208

In addition to the various economic ramifications of Prop. 208 projected in this report, several other consequences are unfortunately likely to unfold:

Prop. 208 Does Not Adjust for Inflation in the Income Tax Brackets:

The proposed tax increase initially only targets individuals with taxable income above $250,000. However, as observed by the Arizona chapter of the National Federation of Independent Business (NFIB), inflation impacts will push more and more individuals into the highest marginal tax bracket even if they are making the exact same income in real terms.[13]

For example, using historical rates of inflation, over the course of 10 years somebody making $200,000 will see their income advance to nearly $250,000 with no real increase in purchasing power. This means the measure will continue to pull more and more taxpayers into the higher tax brackets even if their income is not increasing in real terms. State law prevents this sort of automatic, hidden tax increase from taking place each year by indexing tax brackets to inflation, but Prop. 208’s tax “surcharge” is placed outside those existing tax bracket protections, meaning that every year, more and more Arizonans will be subject to its tax increase even without making more money in real terms.[14]

Prop. 208 Utilizes an Unreliable, Highly Volatile Funding Source:

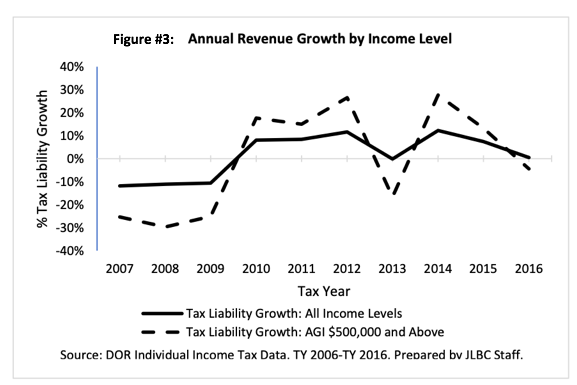

Next, the proposed tax increase targets the upper brackets of the state’s individual income tax, but these tax brackets represent the most unpredictable and volatile of all possible funding options. This means that the amount of actual tax collections generated by the measure and directed to schools is likely to swing wildly from year to year, making it nearly impossible to guarantee ongoing salaries for new staff.

This dynamic is starkly illustrated in Figure 3, which was prepared as part of the Arizona Joint Legislative Budget Committee’s (static) fiscal impact analysis of Prop. 208.[15] Indeed, in contrast to the steady changes in tax revenue generated by all filers (shown in the solid line and typically changing by less than 10% in any given year), the revenues from high-income earners (shown in the dotted line) have repeatedly surged and crashed in alternating years. As explained similarly by the Arizona Tax Research Association:

In FY 2008, the first year of the [Great Recession], individual income tax collections actually grew for filers under $500,000 AGI [adjusted gross income] while they plummeted more than one billion dollars for filers north of $500,000 AGI. In just one year, IIT [individual income tax] collections for high income filers dropped 32%. … Tying teacher’s salaries to one of the most volatile revenue sources is poor fiscal policy not witnessed in any other state and will whipsaw teacher pay based on the fluctuations of the business cycle.[16]

If a stable, reliable source of funding for educators is truly the goal, Prop. 208 is the furthest thing from the answer because the revenues it generates will be among the least dependable of any in the state. What’s more, while the Prop. 208 campaign is estimating annual revenues from the tax increase of nearly a billion dollars, even now the official state estimates are projecting well over $100 million less in revenues.

Moreover, those state forecasts were initially assembled in February 2020, before COVID-19 impacted the economy, and were based on one year of tax collections inflated to the most recent and healthy year. If the estimates were based on business cycle averages rather than a peak year, Prop. 208 would provide an estimated $650 million to $700 million per year, or roughly $300 million less than what is being promoted.

Prop. 208 Starves Other Government Services and Undercuts Arizona’s Ability to Navigate Economic Hardship:

As described above, the economic modeling conservatively estimates $2.4 billion in lost state and local tax revenue over 10 years, resulting from its drag on employment and economic activity. This translates into a minimum state and municipal revenue loss of $240 million per year, including $120 million per year on average from the state General Fund.

Because of the provisions in Prop. 208 and the “Voter Protection Act” of 1998, this revenue can never be backfilled by any revenue generated in association with Prop. 208. This means the state General Fund will need to absorb the estimated tax revenue loss of $120 million per year (or much more). That revenue shortfall in the General Fund would in turn necessitate budget cuts to other areas of government, such as child protective services and public safety. Perhaps the greatest harm would befall Arizona’s public universities, which have historically born the brunt of the education unions’ largesse.[17]

This loss of revenue will also inevitably lead to calls for additional tax increases to “pay” for the damage caused by Prop. 208 and avoid these cuts to other government services. Yet as other high-tax states have witnessed, this quickly leads to a downward spiral that weakens not only the state’s employment base, but also diminishes the value of traditionally safe middle- and low-income investments such as homes.[18]

Since the minimum of $120 million in state tax revenue losses are on top of approximately $120 million in losses that will be realized by local government entities, Prop. 208 will simultaneously impact infrastructure investment and other forms of economic development at the local level.

Prop. 208’s Disastrous Effects Will Be Permanent

Arizona’s so-called Voter Protection Act (VPA) is a constitutional provision that prohibits the state legislature from repealing any voter-approved measure, or even from amending a voter-approved measure unless the amendment “furthers its purpose.” That means that once passed, initiatives like Prop. 208 cannot be changed by the people’s elected representatives. Lawmakers cannot even fix technical errors or typos in a voter-approved measure without a virtually impossible three-fourths supermajority vote from both houses of the legislature. In other words, the VPA makes ballot initiatives for all intents and purposes unrepealable—even in times of emergency or to fulfill an urgent and unanticipated need.

Conclusion

In more normal times, a near doubling of a state’s tax rates would prove economically damaging enough on its own. But in the wake of one of the most severe economic disruptions in generations, a proposal such as the Prop. 208 tax increase represents an especially harmful and ill-timed danger—one that will negatively impact Arizona’s recovery and the state’s ability to again rank as a national leader in key economic statistics.[19]

Arizona voters who are concerned with the quality or funding of our education system ought to demand better than indiscriminate spending increases tied in no way to achievement, improvement, or reform—as under Prop. 208—particularly when paid for by tax increases that damage the economy. Indeed, Arizonans have demonstrated time and again that the best financial engine for our education system is a robust and growing economy, not runaway tax increases: In 2015 voters supported Arizona’s Proposition 123, which raised $3.5 billion without new taxes; and in 2018, legislators authorized nearly $1 billion in additional annual funds for teacher pay increases and additional assistance restorations—made possible by the state’s robust economic growth.[20]

Yet now, the same “advocates” who are pushing Prop. 208 ask Arizona voters to trust them with a tax increase of hundreds of millions of additional dollars—dollars they assure will transform our education system, even though little in the initiative calls for transformation of any sort.

Fortunately, voters will have the opportunity to reject this economically damaging, educationally hollow proposal in November 2020. Equipped with the data in this report, we hope they will take advantage of the occasion and oppose Prop. 208.

End Notes

[1] Lindsay Walker. “Arizona Still Nets Gain of Residents from Other States.” Phoenix Business Journal. December 26, 2019. https://www.bizjournals.com/phoenix/news/2019/12/26/arizona-still-nets-gain-of-residents-from-other.html

[2] “Good for Business and the Arizona Economy.” Invest in Education. Accessed September 6, 2020. https://investined.com/get-the-facts/good-for-business-and-the-arizona-economy/

[3] Molera v. Reagan. Supreme Court of the State of Arizona. 2018. https://www.azcourts.gov/Portals/0/OpinionFiles/Supreme/2018/CV180218APEL.pdf

[4] Jeremy Duda. “In Reprise of 2018 Ruling, Judge Boots Tax Hike for Education Off Ballot.” The Arizona Mirror. July 31, 2020. https://www.azmirror.com/2020/07/31/invest-in-education-in-reprise-of-2018-ruling-judge-boots-tax-hike-for-education-off-ballot/

[5] Interviews conducted by Rounds Consulting Group during 2020.

[6] Greater Phoenix Economic Council, the Arizona Commerce Authority, and CBRE.

[7] Arizona Hourly Earnings. Economic and Business Research Center. University of Arizona. https://www.azeconomy.org/arizona-wages-and-earnings/

[8] Lydia Chew. “Ballot Proposition 208, Invest in Education Act Fiscal Analysis.” Arizona Joint Legislative Budget Committee. 2020. https://www.azleg.gov/jlbc/20novI-31-2020fn730.pdf

[9] Chris Edwards. “Tax Reform and Interstate Migration.” Cato Institute. September 6, 2018. https://www.cato.org/sites/cato.org/files/pubs/pdf/tbb-84-revised.pdf

[10] George Hammond. “Arizona’s Economy: A Shock to the System.” Economic and Business Research Center. University of Arizona. April 1, 2020. https://www.azeconomy.org/2020/04/outlook/arizonas-economy-a-shock-to-the-system/

[11] Heather Long. “Small Business Used to Define America’s Economy. The Pandemic Could Change That Forever.” Washington Post. May 12, 2020. https://www.washingtonpost.com/business/2020/05/12/small-business-used-define-americas-economy-pandemic-could-end-that-forever/

[12] Individual Income Tax Statistics. Tax Year 2015. Arizona Department of Revenue. https://azdor.gov/sites/default/files/media/REPORTS_STATS_2015_Arizona_Individual_Income_Tax_Statistics.pdf

[13] “Failure to Adjust for Inflation Makes Prop. 208 Destructive.” NFIB. September 9, 2020. https://www.nfib.com/content/news/arizona/failure-to-adjust-for-inflation-makes-prop-208-destructive/

[14] Arizona Revised Statutes Section 43-1011(C). https://www.azleg.gov/viewdocument/?docName=https://www.azleg.gov/ars/43/01011.htm

[15] Chew. 2020.

[16] Sean McCarthy. “Invest in Ed Tax Increase Misguided & Cynical.” Arizona Tax Research Association. August 2020. http://www.arizonatax.org/sites/default/files/publications/special_reports/file/special_report_income_tax_initiative_8-3-20.pdf

[17] Lindsay Walker. “Arizona Colleges See Some of Deepest Funding Cuts, Biggest Tuition Hikes Since Recession.” Phoenix Business Journal. October 26, 2019. https://www.bizjournals.com/phoenix/news/2019/10/26/arizona-colleges-see-some-of-deepest-fundingcuts.html

[18] Nadav Houri. “Millionaire High-Tax State Exodus: This Is Only the Tip of the Iceberg.” Forbes Real Estate Council blog post. November 13, 2019. https://www.forbes.com/sites/forbesrealestatecouncil/2019/11/13/millionaire-high-tax-state-exodus-this-is-only-the-tip-of-the-iceberg/#45d209f82404

[19] Office of the Governor. “New: Arizona’s Booming Job Growth Ranks Second in the Nation.” News release. January 28, 2020. https://azgovernor.gov/governor/news/2020/01/new-arizonas-booming-job-growth-ranks-second-nation

[20] Prop 123 Funding Projections. Arizona Joint Legislative Budget Committee. December 3, 2015. https://www.azleg.gov/jlbc/16mayprop123yrlyest.pdf ; FY 2019 Appropriations Report—Department of Education. Arizona Joint Legislative Budget Committee. 2018. https://www.azleg.gov/jlbc/19AR/ade.pdf